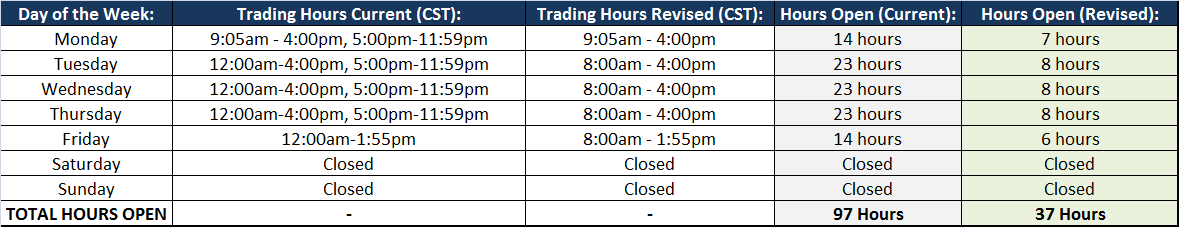

Set for October 27th, CME group will revert to new trading hours in the Livestock sector of the market. The new proposed schedule reduces trading hours in the Livestock sector by nearly 2/3 of its current trading schedule, but how will this affect the market? Will this change in market hours affect my CTA investments that utilize the Livestock sector? These are questions we have heard recently, given the upcoming change. See below the current schedule vs. the revised schedule that will go into affect Oct 27th. Times are listed in central standard time (CST):

How will the new hours affect the market?

As you can see from the above time table, the total amount of hours the market is open is being significantly reduced from 97 hours to 37 hours a week, mostly eliminating overnight trading. The change in market hours came after light overnight volume, which resulted in higher volatility in the markets during these hours. Noticing greater volatility during the overnight trading hours, the CME group, consulted livestock traders, producers and other market participants to poll how to make the market more consistent and less volatile. The majority of the market participants agreed that reducing the market hours in the Livestock sector would help create more liquidity and consistent pricing. This change in Livestock hours comes a little over a year after the CME also reduced its Grain trading hours, for similar reasons.

Will this change in market hours affect my CTA investments that utilize the Livestock sector?

The short answer to the question is no, it will not affect your CTA investments. If anything, reducing the amount of time the markets are open will help strategies remain more consistent, by eliminating volatile market moves during overnight hours due to light volume. Eliminating the overnight trading hours will build more anticipation for the morning open, attracting more buyers/sellers at the 8am CST open time, creating more liquidity. In summary, the Livestock sector consists of three markets, Live Cattle (also referred to as Fat Cattle), Feeder Cattle, and Lean Hogs. Out of the three markets, Live Cattle is the most highly traded, followed closely by Lean Hogs and then Feeder Cattle. Mark your calendars, the new trading hours will go into effect this Monday morning on October 27th, 2014.