When evaluating a basket of CTAs across multiple categories, why is it that we compare how many assets under management a CTA has? Obviously, if a CTA is just starting out and has $0 under management, it’s rare for an investor to take a chance with them, since it is unknown whether they will perform the same with client assets as they did with proprietary assets. But outside of this scenario, it’s common for an investor to assume that a commodity trading advisor that manages a $100M, must be better than one managing only $25M. The perception is that CTAs that have large sums of assets under management are better investment managers. Is this a case of “perception is reality?”

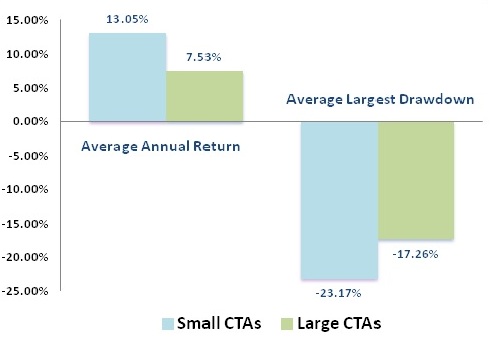

While our gut feeling told us that perception is NOT reality, we wanted to conduct some research to test the opinion that larger CTAs are better investment managers than smaller, or emerging CTAs. Therefore, we went on our CTA database and found the average annual rate of return and largest drawdown for a group of large managers and a group of small managers. The group of large managers consisted of the ten largest CTAs by AUM in our online database. The group of small mangers consisted of the ten smallest CTAs by AUM in our database with a minimum of $10M under management. Here are the average results across both groups of CTAs:

As you can see from the above chart, the evidence to support the notion that larger CTA managers are better traders is inconclusive. Large CTAs do not seem to produce an average annual return as high as small CTAs, but large CTAs seem to be better managers of risk. On the other hand, small CTAs generate a higher return, but are also susceptible to larger drawdowns than larger CTAs. The mystery still remains…why are larger CTA managers perceived to better traders?

We believe the primary reason is because larger CTAs are better able to disseminate information than small CTAs. CTAs managing hundreds of millions of dollars have a dedicated marketing/support staff which allows them to market the CTA’s brand more effectively. In turn, this leads to investors repeatedly hearing the CTAs name, and therefore, concluding the CTA is a “brand name.” Larger CTAs also have more advertising dollars, which allows them to sponsor more events in order to get their name out. Large CTAs’ team of research analysts are able prepare and provide prospective investors with in-depth analysis into the CTA’s historical performance data and trading strategy. When a prospective investor sees a very complicated excel file, or a very detailed power point presentation come across, they are likely to say “oohh” and “ahhh.”

So how are talented small CTAs supposed to get to the level of large CTAs where they can eventually have their own marketing and research teams? It’s the prototypical “what comes first, the chicken or the egg” question. Do CTAs grow their AUM first and then establish a marketing/research team, or does a CTA hire a marketing/research team first in order to gain AUM? There is no easy answer to this question, but generally a CTA grows its team, as it grows in assets in under management. As a savvy investor, it’s important to be able to identify good investment mangers regardless of their AUM. By doing so, you can look past the better marketed CTAs that you might think are good.