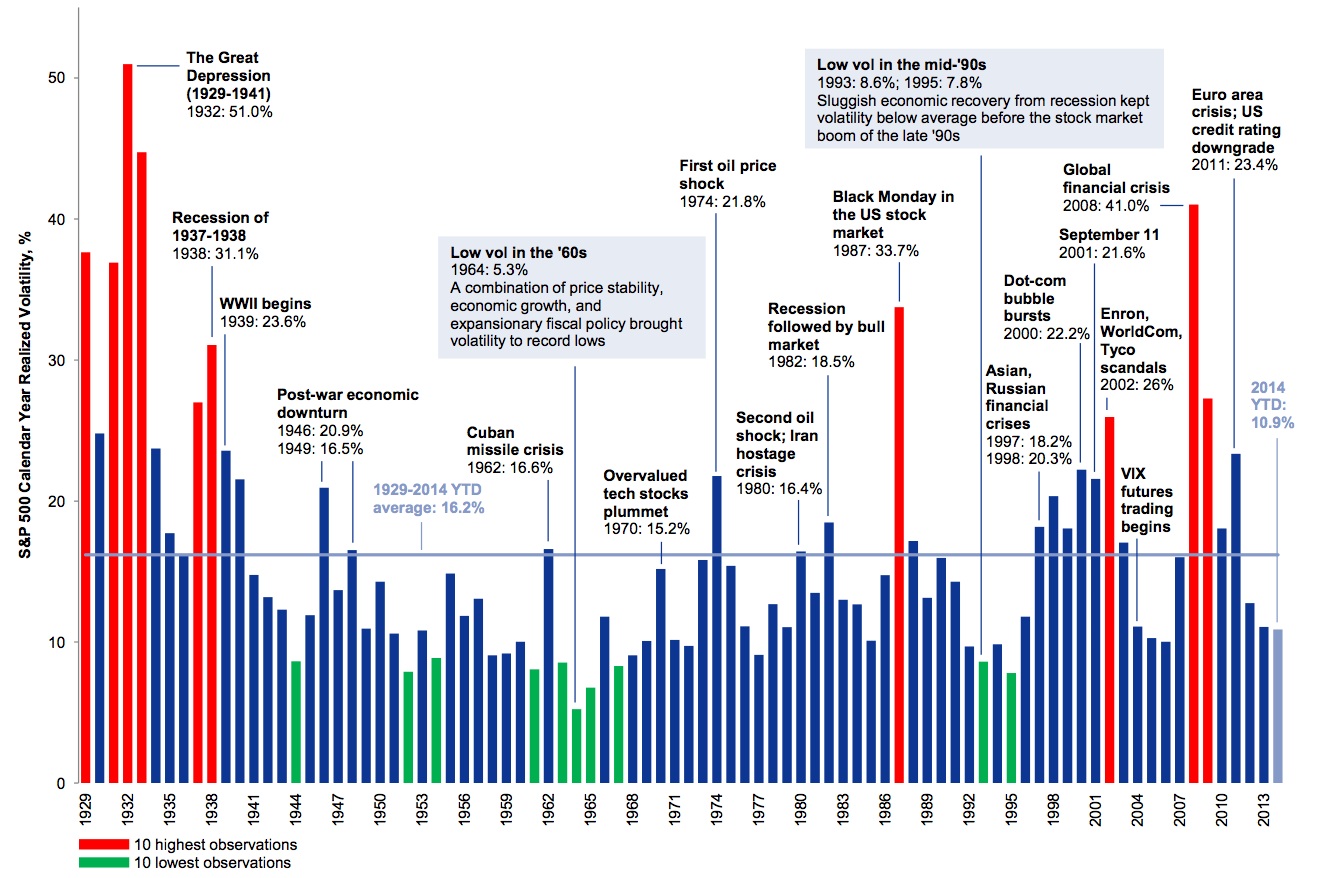

The short answer is…we’re not sure, but by the time we realize it, it may be too late. In order to get a bit of perspective on historical volatility, below is a very informative chart prepared by FT Alphaville that gives the ten lowest and ten highest observations of volatility dating back to 1929. As you can see, some of the highest spikes in volatility came at obvious times during our country’s history: The Great Depression, WWII, Black Monday, Enron, and the Global Financial crisis of 2008:

Source: FT Alphaville

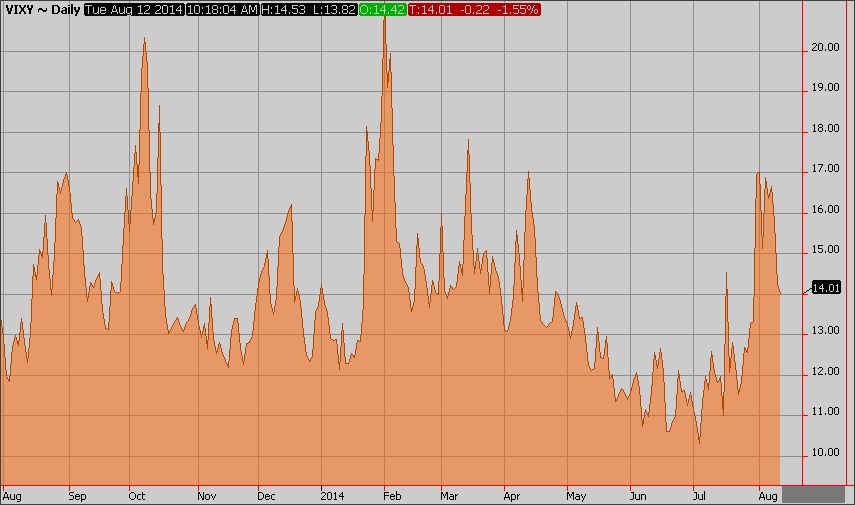

If you look below, since 1990, volatility has consistently hovered around 20, with periods of high volatility approaching and exceeding 30. From 1997 through 1999 there was the Asian Contagion and Long Term Capital Management, then we watched the internet bubble burst in 2000, which was followed closely by the 9/11 attacks, and Enron and WorldCom. After Enron and Worldcom, volatility simmered down for a few years only to spike back up during the subprime mortgage debacle and the collapse of Lehman Bros. We saw another brief spike in volatility during the flash crash, but volatility has since been declining.

As we focus further below, we see that spikes over the last year have been fairly tame on a relative basis. They have coincided with mild pullbacks of a few percent in the equity indices and quickly reversed with no lasting effect as the indices simply shook them off and marched on to new highs as volatility declined.

Over the last couple of weeks we have seen an increase in volatility: is this another “head fake” or a sign of things to come? We certainly can’t predict when volatility will return for an extended period, however, it would seem that the stage is set should it like to stick around. With the current global situation, catalysts seem to abound: Russia/Ukraine, ISIS/Iraq, Israel/Hamas, Economy/FOMC, Ebola outbreak, and on and on. Despite the many global factors that suggest volatility could be here to stay, the x-factor still seems to be the Federal Reserve’s monetary policy. Economists continue to believe that volatility will remain historically low until the Fed takes initial measures to begin increasing rates.