“In the spring a young man’s fancy lightly turns to thoughts of love.” Putin was not thinking of Lord Tennyson when he lustfully grasped for Crimea and eastern Ukraine but his desire is heartfelt, nevertheless. The West (see how that Cold War nomenclature slips readily back into the vernacular?) is flummoxed, not willing to fight but not willing to concede either. Western Europe is too busy trumpeting their economic stabilization while the US is too-willingly distracted by domestic issues from a no-win foreign policy situation. China too has its own problems and with critical natural gas and oil contracts with Russia in play, they are willing to overlook a little Soviet-style adventurism. After all, China has its own eyes on parts of Japan, Korea, Taiwan and the Philippines – not for the territory itself but for the extension of drilling rights and naval power projection. Finally, Syria drags on with Assad finding some leftover chemical weapons (forgot to tell the UN by accident) but Libya made progress on getting its oil fields and exports operational again. Finally, spring is the time when the farmer’s fancy turns to weather; it is warming up nicely despite the late cold and rain. Planting expectations look good – but then they looked good back in early 2011 before the drought too. As for me, I look to the Rubiayat of Omar Khayyam for springtime inspiration: “A Book of Verses underneath the Bough / A Jug of Wine, a Loaf of Bread–and Thou.”

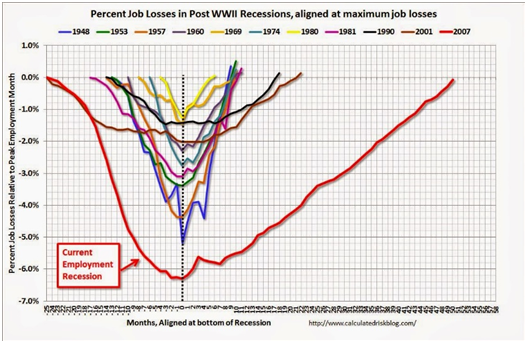

Making Up for Lost Time: Finally – finally – it appears the US has recovered the jobs lost since the beginning of the “Great Recession,” with the last jobs number for April coming in at +288,000 positions, the most since 2012 and notably more than the average estimate of 212,000.  February and March’s levels were also revised upwards by 38,000 jobs. So much for the Polar Vortex crippling the labor market. These positive statistics helped knock the unemployment rate to 6.3%, which also unfortunately declined from a reduction in the participation rate by 0.4% to 62.8%. Unfortunate in the sense that fewer people are looking for work, i.e., they have given up. Also unfortunate is that median income continued to stagnate, falling approximately 0.7% in March. Per South Bay Research, the breadth of the private payroll strength was quite impressive – from white collar positions down to dry cleaners. Looking ahead, in their opinion, some of the hiring will not be repeated, particularly in construction; however, seasonality factors should goose the number nicely.

February and March’s levels were also revised upwards by 38,000 jobs. So much for the Polar Vortex crippling the labor market. These positive statistics helped knock the unemployment rate to 6.3%, which also unfortunately declined from a reduction in the participation rate by 0.4% to 62.8%. Unfortunate in the sense that fewer people are looking for work, i.e., they have given up. Also unfortunate is that median income continued to stagnate, falling approximately 0.7% in March. Per South Bay Research, the breadth of the private payroll strength was quite impressive – from white collar positions down to dry cleaners. Looking ahead, in their opinion, some of the hiring will not be repeated, particularly in construction; however, seasonality factors should goose the number nicely.

All this employment news provides the political cover for Yellen as she can continue to measurably reduce unneeded monetary injections into the economic system while claiming “Mission Accomplished.” Do not worry about me being too harsh on her – I point the blame finger primarily at Bernanke. I more worry about what she will do (or not have the guts to do). At least Volker is still alive, unlike the Q1 GDP growth at +0.1%. Now with an annualized number like that, one must assume that there were some accounting shenanigans pushing that number to the positive side. If it was negative, no matter how marginal, both Yellen and Obama would be hit with some serious flak. Instead, weather was blamed again as consumption grew well ahead of expectations but both business investment and exports fell shy of the mark. Of the 3% consumption growth number, 1.1% was medical spending. Obamacare was looked at as the cause for that increase. I prefer to withhold judgment until the revisions come in and we see the breakdown for Q2 and Q3 since we really do not know the net current impact of the new health insurance law.

West Riding Higher, East Spiraling Lower: Western Europe is feeling pretty good about itself on a sea of easy money while Eastern Europe is hitting reality hard and anxious about the future. The peripheral countries in particular (PIIGS) are enjoying record low rates as bond money left emerging markets and headed to lands with the Draghi Put in place. Greece, the ultimate poster child that still may receive additional debt relief from the troika, issued €3 billion in 5-year bonds at 4.95%. Demand was heavy with €20 billion offered. Why the strong demand? Partially because these bonds will come due before the troika debt does – therefore the risk of a 2012-type haircut is minimal. Greek banks also took advantage of the proffered money with National Bank of Greece offering €750 in senior notes (rated Caa1 but that was no deterrent) and €2.5 billion in shares. Timing is everything. Portugal also issued bonds for the first time since the market collapse with a 10-year €750 million issue. Spain offered its first IPO since the crash – an on-line travel company raised about €433 million. Romania (BB+ rated) issued a 10-year €1.25 billion bond at 3.7%, a record low. Italy’s cost of borrowing fell to a euro-era low of 3.22% for 10-year debt at the end of April. Private equity firm Carlyle Group is cashing out on €1.1 billion in shares in Applus, a Spanish industrial testing business. A final example of this phenomenon is the record €21 billion combined junk bond offering of Numericable and its parent Altice. With an order book eclipsing €100 billion, the telecom/cable operator beat the previous record from 2006 by NXP Semiconductors by almost €6 billion. Just maybe a little yield chasing? Time to start locking in low rates / monetizing profits while the window is open.

From an economic view, there was some positive support. The IMF upticked US and European growth for 2014 modestly, stating that “the recovery which was starting to take hold in October [of 2013] is becoming not only stronger, but also broader.” Spanish Q1 GDP growth hit +0.4% quarter-on-quarter, the fastest rate of growth in six years. It too sold 10-year bonds at record-low yields of 3.01% in late April. European factory activity indicated an increase month-on-month with a PMI number of 53.4, with all member countries indicating expansion. Unemployment is still stuck at 11.8% Euro-wide (last figure is from March), however. European banks are still repaying the €1 trillion LRTO from 2011/12 at a record pace, with €9.5 billion repaid the last week of April.  ECB excess liquidity fell below €100 billion, indicating a slow move back to some kind of monetary balance (unlike the US, where the Fed is still cramming unneeded liquidity down the throats of its financial system).

ECB excess liquidity fell below €100 billion, indicating a slow move back to some kind of monetary balance (unlike the US, where the Fed is still cramming unneeded liquidity down the throats of its financial system).

April ended with Russia invading eastern Ukraine via proxy. The “little green men” as the pro-Russian militia are called effectively took over the major cities in the region close to Russia and declared their freedom from Kiev.  There is little doubt in my mind that FSB (the successor organization to the KGB) is involved [1] and possibly Spetsnaz (military special forces). The Ukraine has been slow in counter-attacking due to the government’s need to get organized after taking power as well as having to address suspicions that military and police units would be loyal to Ukraine and not to the rebels (apparently some elite paratrooper units were actually disbanded on such loyalty issues). As the counter-attacks are underway now, it is too early to know how successful Ukraine will be in reasserting its sovereignty. In addition, there are elections to be held on May 25th that could further disrupt effective operations. The good news at this hour is the rejection of pro-Russian mobs in Odessa, a key city on the Black Sea. Pro-Russian ascendency there would disrupt the grain export markets as well as be a deep psychological blow to the fledgling regime. The effect of Western sanctions has been minimal in terms of halting business, though the financial markets have been shaken – the Russian RTSI index was down 5.7% in April while the ruble was about 2% weaker (and is down about 10% for the year). Standard & Poor’s cut Russia’s credit rate to BBB- (right above junk) and the Russian central bank raised overnight rates to 7.5% to keep further currency losses in check and to battle inflation which spiked to 7.2% in April. Of course this rapid increase in interest rates should hurt the economy. The IMF cut their GDP forecast to +0.2% from +1.3% for 2014 and Q1 saw a decline of 0.5% from the previous quarter. Meanwhile, corporate bond issuance has fallen 75% to €9.1 billion in 2014 versus the same period last year. Japanese banks reportedly have pulled out of loans and suspended credit lines, including export financing that would be required for companies to conduct business. Russia imports 40% of its food and half its medicines so the decline in the ruble has a powerful impact on the day-to-day functioning of the country. There is more economic strife to come as Gazprom has threatened to cut off natural gas shipments to Ukraine if not paid by May 7th (update before going to press, Gazprom switched over to pre-payments starting for June shipment after no payment in April pushing the amount claimed to over €3 billion). In a geopolitical twist, Russia owns $3 billion in Ukrainian bonds which may be used to declare Ukraine bankrupt and accelerate further debt owed to Gazprom. And we have not even discussed the impact on other Russian neighbors. We will only mention Finland which Standard and Poor’s has put on negative watch due Russian exposure, threatening its AAA credit rating. If cut, that leaves only Luxembourg and Germany with S&P’s highest rating. Perhaps the West has not completely escaped the threat of sinking into the mire as well.

There is little doubt in my mind that FSB (the successor organization to the KGB) is involved [1] and possibly Spetsnaz (military special forces). The Ukraine has been slow in counter-attacking due to the government’s need to get organized after taking power as well as having to address suspicions that military and police units would be loyal to Ukraine and not to the rebels (apparently some elite paratrooper units were actually disbanded on such loyalty issues). As the counter-attacks are underway now, it is too early to know how successful Ukraine will be in reasserting its sovereignty. In addition, there are elections to be held on May 25th that could further disrupt effective operations. The good news at this hour is the rejection of pro-Russian mobs in Odessa, a key city on the Black Sea. Pro-Russian ascendency there would disrupt the grain export markets as well as be a deep psychological blow to the fledgling regime. The effect of Western sanctions has been minimal in terms of halting business, though the financial markets have been shaken – the Russian RTSI index was down 5.7% in April while the ruble was about 2% weaker (and is down about 10% for the year). Standard & Poor’s cut Russia’s credit rate to BBB- (right above junk) and the Russian central bank raised overnight rates to 7.5% to keep further currency losses in check and to battle inflation which spiked to 7.2% in April. Of course this rapid increase in interest rates should hurt the economy. The IMF cut their GDP forecast to +0.2% from +1.3% for 2014 and Q1 saw a decline of 0.5% from the previous quarter. Meanwhile, corporate bond issuance has fallen 75% to €9.1 billion in 2014 versus the same period last year. Japanese banks reportedly have pulled out of loans and suspended credit lines, including export financing that would be required for companies to conduct business. Russia imports 40% of its food and half its medicines so the decline in the ruble has a powerful impact on the day-to-day functioning of the country. There is more economic strife to come as Gazprom has threatened to cut off natural gas shipments to Ukraine if not paid by May 7th (update before going to press, Gazprom switched over to pre-payments starting for June shipment after no payment in April pushing the amount claimed to over €3 billion). In a geopolitical twist, Russia owns $3 billion in Ukrainian bonds which may be used to declare Ukraine bankrupt and accelerate further debt owed to Gazprom. And we have not even discussed the impact on other Russian neighbors. We will only mention Finland which Standard and Poor’s has put on negative watch due Russian exposure, threatening its AAA credit rating. If cut, that leaves only Luxembourg and Germany with S&P’s highest rating. Perhaps the West has not completely escaped the threat of sinking into the mire as well.

Eye of the Storm: April was a pretty quiet month in Asia. It was too soon to know if Japan will roll over from the increase in the sales tax that went into effect at the end of March, but undoubtedly there will be an update in the next few commentaries. China kept a low profile with one exception as it struggled through the month. The industrial gauge PMI again showed contraction in April making it four months of slower economic activity. Q1 2014 GDP growth was 7.4% annualized, down from 7.7% in Q4 2013. Industrial output was up 8.8% for March versus an expected 9.0% rise. In response to the GDP slowdown, the government announced that no mini-stimulus would be implemented and the attention would be on medium to longer-term structural reform. Credit issues made most of the headlines. The Chinese government failed to sell all its bonds at the rate that it desired, issuing about $3.3 billion in one-year notes instead of the planned $4.5 billion. In Q1, the government cut about $90 billion from the supply of credit which was seen as new shadow banking trust loans were down 78% versus the same period last year. Trust loans are also more predominately seen in the portfolios of smaller banks, making up about 23% of their assets in 2013, up from 14% in 2012 and at only 2% for leading banks. The exception headline that received media attention was the that Chinese GDP is set to overtake the US GDP based on real GDP adjusted for purchasing power parity in 2014 instead of 2019 per the World Bank. The PPP adjustment is critical as the assumptions on purchasing power were changed recently to favor emerging countries (basically, money goes further in poor countries). Obviously the high rate of Chinese growth versus the US also has caused that country to close the wide gap over the last ten years. On the other hand, expensive and slow growing countries (e.g., the UK and Japan) lost significant ground using this updated measurement. This is not the only word on the subject – using exchange rates, the IMF found that US GDP is twice that of China’s. Finally, if there is some kind of credit crunch in China, these figures could change yet again.

In less good news, 20% of China’s agricultural land is estimated to be polluted, particularly in the rice-growing regions in the south. Hazardous levels of toxins including cadmium, nickel, arsenic, lead and mercury have been found in the Yangtze and Pearl River deltas. The Hunan province not only is China’s largest rice producer, it is the center of the lead, zinc and minor metals mines and smelters, and rice grown there shows much greater than acceptable levels of poisons. The interesting aspect is that the government report containing this information was classified as a state secret (of course!) until a lawyer made a successful freedom of information request (surprising!). In stock market reforms, China announced links between the Hong Kong and Shanghai stock exchanges, allowing Chinese to trade 250 international stocks on the Heng Seng while permitting foreigners to trade local shares on in Shanghai. There are quotas and limitations in place but a big step towards internationalization and harmonization of China’s markets. Perhaps there is real reform going on there after all. Finally, in frontier market bond news, Sri Lanka yields hit record lows with a sale of $500 million of five-year debt at 5.125 percent after Zambia sold one billion dollars of ten-year bonds at 8.625% in Africa’s first sovereign debt deal this year. Pakistan is considering a $2 billion deal split evenly between 5-year and 10-year paper at similar levels (7.25% and 8.25%, respectively. Chasing that yield!

How to Ruin a Country: Exhibit One: Iran. With full due credit to former President Ahmadinejad, the increasing of the money supply sevenfold over eight years (from $27 billion in 2005 to $189 billion in 2013) to pay for extensive housing programs and energy subsidies while privatizing state-owned businesses by giving them away to your Revolutionary Guard cronies is not a good way to build a legacy. The result is that your successor President Rouhani has to increase fuel prices by 40%, electricity, water and gas by 20% and interest rates to 14.15% to try to get the budget and money supply under control. By “under control,” he means get the inflation rate down to 25% annualized by March 2015. Ben Bernanke, this may not be “hyperinflation” but it is pretty close. Exhibit Two: Syria. We all know about the civil war, the chemical weapons and involvement by foreign powers. What also is going on is that there is an intense conflict between the radical jihadist groups for control of the eastern oilfields. Although modest in size, the millions generated monthly keep the rebel groups supplied and in the game, even if they cannot take control of the country. Exhibit Three: Libya. Finally there seems to be a deal brokered between the east and west halves of the country to get the oil exports restarted in the east, bringing high-quality crude oil back on the world markets. While not expected to hit the previous highs of 2011 of 1.4 million barrels per day anytime soon, production is expected to more than double to 350,000 and increased exports would follow. Unfortunately, this negotiation covers only two of the four terminals, leaving the two largest (Es Sider and Ras Lanuf). So perhaps more progress to come. Or another opportunity to slip back into chaos.

In more developed markets, the US “tested” a release of 5 million barrels from its oil Strategic Petroleum Reserve, just to make sure that the system is working. A small amount compared to the 965 million barrels in storage, it was a warning shot to Russia, which is highly dependent on oil prices for its budget. The threat of a more substantial release, especially in conjunction with Saudi Arabia, could act as a deterrent to further Ukrainian and Syrian instigations. With US private stockpiles at 397.7 million barrels, eclipsing the previous record set in 1931, there is a risk of a world glut as US imports continue to dwindle and those cargos need to find a home elsewhere. Enbridge announced its plans to start exporting Canadian crude oil via the Gulf of Mexico after transporting it through the Keystone pipeline. Their license is for a small amount (about 40,000 barrels) so this is more of a wake-up call that Canada is actively pursuing alternatives from the US market. In the last six months, the US Department of Commerce approved 52 oil re-export licenses, mostly to Canada but also 14 to Europe and 6 to South America. If we do not let our friends up north export via Keystone (or the Keystone expansion being delayed by Obama), then Canada may build their own pipeline to the west coast to supply China directly. Speaking of China, one booming business for them is refining – China became a net exporter of refined oil products in March, the third time since records began in 2004. With refineries being built faster than domestic demand, this opportunity could upset the old guard of Singapore and Korea as Asian sources of gasoline and diesel.

The Hong Kong Exchanges and Clearing firm unveiled plans to offer coal and industrial metals futures denominated in renminbi, building on its purchase of the London Metals Exchange in 2012. They will be cash settled rather than London’s physical settlement. Obviously there is the timing of the linkage between the Hang Seng and Shanghai exchanges that was mentioned earlier. Barclays Bank announced that it would make further reductions in its commodities businesses, refocusing on electronic brokering and keeping its physical gold and silver vaults (remember that they are counted as currencies under Dodd-Frank and thus can operate freely). UBS has backed away from the indexing business as it transferred administration to Bloomberg of its portion of the Dow Jones – UBS index family which has about $80 billion benchmarked to it. Still technically the owner, UBS eliminated a regulatory requirement on stricter oversight. The index will be known after July 1st as the Bloomberg Commodity Index.

Invest wisely!

David Burkart, CFA

Coloma Capital Futures®, LLC

Special contributor to aiSource

Additional information sources: Bloomberg, Financial Times, South Bay Research, United ICAP, and Wall Street Journal.

[1] Note that the FSB, like the KGB, is a military service like the Russian army or navy, and not only deals with intelligence matters, but also internal and border security. Per Wikipedia (and recalling my previous studies of the KGB), there are 200,000-300,000 personnel in the FSB (including 160,000 border guards and 4,000 special forces troops) and it has access to the full range of military hardware as well as the proper training to engage in the type of propaganda, logistics and organization seen in Ukraine. Putin, as the former head of the FSB, would have full knowledge of its capabilities.