Welcome to the 19th Century everyone as Russia reminded Europe and the US that “soft power” cannot stand against boots on the ground. Longer term it is a foolish maneuver given Russia’s economic challenges and the poverty of the Crimea, but for now it serves Putin’s purposes. As long as Natural Gas keeps flowing to Europe… The US was on the back burner newswise this month apart from its spectacular equity market which will not be denied new highs. South America continues to stumble with riots and a crackdown in Venezuela as economic collapse threatens. China may be able to dictate a growth rate officially, but dealing with a possible credit crisis will take more than just words. Japan should see a nice pick-up in economic activity in March as citizens buy goods in front of the April increase of the national sales tax from 6% to 8%. Will the markets look past this temporary stimulus or mistake the temporary activity as trend? Finally, as we discovered with the collapse of Mt. Gox and the missing $500 million in client money, Bitcoin does not offer refuge from such macroeconomic strife.

Speak Softly and Carry A Big Checkbook:[1] The lack of political news was obviously good news as sufficient Republican support allowed the passage of unbounded debt accrual under the new debt-ceiling law. More specifically, there is no limit through March 16, 2015 (conveniently after the November 2014 elections). The Federal Reserve Board did not meet in February so there was no “taper tantrum” to upset the market, despite the release of meeting minutes showing strong support for continued, if measured, tapering of the QE3 bond buying program. February and current economic news appears strong enough to allow for another $10 billion decline, Yellen’s first official taper announcement. The market will instead focus on statements around the ZIRP (Zero Interest Rate Policy) and how much longer that will continue. I expect her dovish tones to continue. There is still no inflation (apart from luxury goods, Bay Area real estate and stock / bond markets) and unemployment is still hanging around the 6.6% level. There has been some concern that February’s cold weather affected economic activity (industrial production, previously-owned home sales). Of course, looking at the graphs below, the US is at levels that are a challenge to increase from as well as it has showed steady improvement from 2010 with this latest data point a minor blip.  It would be a mistake to say that this is a definite change in the trend, especially with ongoing on-shoring of manufacturing and relatively low energy prices. Lower existing home sales (seasonally adjusted) is a real issue, on the other hand, but this has been a trend since the real estate bubble popped in 2008. Higher home prices (+11.3% nationwide in Q4 2013 from a year earlier) may be related as much of the sales are investment related as opposed to owner-occupied. Besides the real home-buying season is yet to begin for a few months – let’s talk about housing shortages later. Finally, a reminder that all these statistics are often subject to revision as Q4 GDP was reduced from +3.2% to +2.4%, generally because of lower-than-estimated consumer spending and net exports. However, it is still growth and I think the revised number will not affect the Federal Reserve’s tapering decision.

It would be a mistake to say that this is a definite change in the trend, especially with ongoing on-shoring of manufacturing and relatively low energy prices. Lower existing home sales (seasonally adjusted) is a real issue, on the other hand, but this has been a trend since the real estate bubble popped in 2008. Higher home prices (+11.3% nationwide in Q4 2013 from a year earlier) may be related as much of the sales are investment related as opposed to owner-occupied. Besides the real home-buying season is yet to begin for a few months – let’s talk about housing shortages later. Finally, a reminder that all these statistics are often subject to revision as Q4 GDP was reduced from +3.2% to +2.4%, generally because of lower-than-estimated consumer spending and net exports. However, it is still growth and I think the revised number will not affect the Federal Reserve’s tapering decision.

Noteworthy in the bond world, we have the continued workout of the debt of Detroit which revealed a debt plan that hit retirees up to 33% of their outstanding unfunded pension liabilities. That limited recovery plus the existing pension assets means that the net cuts to individual pensions may range from 10% to 50% depending if one was a public safety employee (most protected) to a general employee (least protected). Health care cuts and higher co-pays complicate the picture, just to be aware. In comparison, the unsecured general obligation bonds are slated to receive cuts of 80%. But the battle continues… Finally both Fitch (who?) and S&P warned against debt collateralized by bank loans and rental income. In fact, S&P decided that the new rental bonds being sold by Blackstone do not deserve the top AAA rating as their “operational infancy” means that there is no history to confidently state their safety. If only they showed such prudence during the previous real estate cycle, at least with sub-prime lending. Moody’s on the other hand, gave their top rating to senior tranche of the issue. Maybe they deserve a lecture by Warren Buffett (who owns 12% of the firm).

Overlooked by the media is the rioting and economic collapse in Venezuela as oil revenue declines but they still have debt payments due on $60 billion in government bonds. In fact, the Wall Street Journal reported that the government has stiffed private enterprises $50 billion in accounts payable so far despite their critical role in the economy.  These companies range from oil servicing ($14 billion owed) to airlines ($4 billion) to importers like supermarkets ($9 billion), all of which need hard currency to import products or buy foreign-denominated services. Foreign firms have $10 billion trapped since 2008 (e.g., Toyota Venezuela had to shut production because it could not get dollars for parts). President Maduro cannot even afford to nationalize these firms like he has other parts of the economy as then the government would have to cover their foreign exchange needs. Talk about Chavez’s socialist legacy! The importance is of course oil, which production has been slowly falling (from 3.1 million barrels per day to 3.0 million over the last ten years while other countries have been expanding their production) and the obligations have been increasing (310,000 barrels per day go to pay Chinese loans, 400,000 barrels are sent to allies like Cuba and Bolivia, and 600,000 are sold domestically at pennies on the dollar). At a 16% interest rate, Venezuelan bonds trade lower than Ukrainian bonds (which yield about 10%). Once again there is evidence that state-controlled economies work as long as they have access to other people’s money. On the other coast, Brazil is also showing slower growth, with GDP growing only 2.3% in 2013 and likely having entered a recession with Q3 and Q4 2013 indicating negative growth. President Rousseff is up for election this year so expect the emerging market news to focus on this troubled country, though one with magnificent resources in agriculture and energy. With inflation at 5.6% and central bank interest rates at 10.5%, 2014 expectations are only for 1.5% growth – which assumes a recovery from this recession. Something to watch down south with the World Cup this summer and the Olympics in 2016.

These companies range from oil servicing ($14 billion owed) to airlines ($4 billion) to importers like supermarkets ($9 billion), all of which need hard currency to import products or buy foreign-denominated services. Foreign firms have $10 billion trapped since 2008 (e.g., Toyota Venezuela had to shut production because it could not get dollars for parts). President Maduro cannot even afford to nationalize these firms like he has other parts of the economy as then the government would have to cover their foreign exchange needs. Talk about Chavez’s socialist legacy! The importance is of course oil, which production has been slowly falling (from 3.1 million barrels per day to 3.0 million over the last ten years while other countries have been expanding their production) and the obligations have been increasing (310,000 barrels per day go to pay Chinese loans, 400,000 barrels are sent to allies like Cuba and Bolivia, and 600,000 are sold domestically at pennies on the dollar). At a 16% interest rate, Venezuelan bonds trade lower than Ukrainian bonds (which yield about 10%). Once again there is evidence that state-controlled economies work as long as they have access to other people’s money. On the other coast, Brazil is also showing slower growth, with GDP growing only 2.3% in 2013 and likely having entered a recession with Q3 and Q4 2013 indicating negative growth. President Rousseff is up for election this year so expect the emerging market news to focus on this troubled country, though one with magnificent resources in agriculture and energy. With inflation at 5.6% and central bank interest rates at 10.5%, 2014 expectations are only for 1.5% growth – which assumes a recovery from this recession. Something to watch down south with the World Cup this summer and the Olympics in 2016.

Anschluss, We Hardly Knew Thee: In 1938, Hitler annexed Austria to further his dreams of a pan-Germanic state which was subsequently supplemented by the primarily-German regions of Sudetenland of Czechoslovakia and Memelland of Lithuania. Although this action directly broke the Treaties of Versailles and St. Germain, the WWI Allies (US, France, UK, etc.) reacted with relatively moderate verbiage and continued appeasement (Prime Minister Chamberlain being one but not the only leader charged with this anemic response). In 2014, Putin threatens to annex the Crimea (he would say take back the “gift” that Khrushchev (a Ukrainian) gave to the Ukraine) on the basis that it would unite Russian-speaking peoples into a pan-Russian state, which would have followed the effective annexation of Russian-speaking areas of Abkhazia and South Ossetia from the country of Georgia. Although this action breaks the Budapest Memorandum Treaty of 1994 signed by President Clinton and others, the West has so far reacted with relatively moderate verbiage and continued appeasement. Setting aside which side of this action is right (the joyful reuniting of Russians with Russians or the shifting of sovereign boundaries by military force), here are the consequences and questions as I see them:

Leadership Stature: Autocrats need to continue to justify their rule and appeals to nationalism via propaganda are a tried and true Soviet approach. Having boots on the ground among a (partially) cheering populace (or a populace that only dares to cheer given the alternative) is a thrilling moment. Looking strong and decisive versus a fractured opposition by the Ukrainian and European (let along American or other) governments is even more ego-boosting. Advantage: Putin.

Military Strategic: While the Russians had effectively free access to their Crimean bases until 2042, annexation would facilitate the responses and movements for Russian forces at a critical warm water port in a critical zone (Middle East / Mediterranean) without the interference of Ukrainian customs. This location would be even more critical should the navel facilities in Syria become unavailable. Advantage: Putin.

Economic Strategic: The Crimea is one of the poorest regions of Ukraine, with GDP per capita about 2/3rd that of Ukraine as a whole. In addition, the area only contributes 3% of national GDP. There are 2 million people in the Crimea versus 43 million in the rest of Ukraine. Monthly wages are not only lower than the average, but have fallen further behind the last ten years. Estimates in the FT claim that Russia will have to put an additional $500 million to $1 billion dollars into the economy annually, so it is not an accretive acquisition. The main industries are tourism (from Russia and Ukraine) and agriculture (though not the vaunted “Black Earth” that makes up Ukraine’s agriculture). There are some offshore energy fields (gas and oil) but the coal fields are located in Eastern Ukraine. However, Ukraine is still heavily dependent on Russia for energy and nuclear power is suspect thanks to the Chernobyl accident. Short-term Advantage: Putin. Long-term Advantage: Ukraine.

Popular Reaction: The rest of Ukraine now has a rallying point against Russia and towards the EU. If the Ukrainian leadership can get organized and past the stultifying corruption, then the EU and NATO may have a new member very quickly. Memories are long in that part of the world – the Ukrainians remember the 1932-33 forced starvation of at least 2.5 million people by Stalin (which is apparently why Khrushchev gave the Crimea to Ukraine in 1954). While they have to overcome a number of obstacles (including Russian power politics over natural gas debts), Putin’s decision to be a bully is likely to harden the Ukrainian heart. Advantage: Ukraine.

So it is pretty apparent when you put it together – Putin is ahead today and riding high. However, can his faltering Russian economy (see last commentary) supported by his declining population that is bifurcated between the powerful few oligarchs and the captive masses really afford, let alone exploit, the advantage he has gained so far? The clock is ticking, which may be part of why he made the move in the first place. Also we need to watch the other countries with high Russian populations, strategic locations and/or former Russian/Soviet rule: Latvia (27% Russian), Estonia (24%), Belarus (12%) and Moldova (part of Romania) (10%).

Meanwhile the rest of Europe is limping along on Draghi’s forever free money (imagine what would happen if he raised rates!). Factory activity expanded for the eighth straight month, although lower than January’s reading. Annualized EU GDP for Q4 2013 was up +1.1%, minimizing the decline for the year -0.3%. Germany, France, Italy and Spain put out positive GDP numbers and Greece contracted at a lower rate than Q3 (Hey, less-bad news is good news when you are Greece). Demand for European debt seems to be the brightest sparkle, with Portugal issuing €3 billion in debt and even tiny Slovenia with a $3.5 billion offering). Turkey too sold bonds, $1.5 billion worth due in 2045. What happened to the S&P bond outlook downgrade on Turkey to “negative” two weeks before? Greece is fighting with the Troika over how much new borrowing the Greek banking sector needs – €6 billion or €20 billion – which is delaying the remaining €10.1 billion bailout money that Greece so desperately needs (Hey, the decline in GDP is slowing! Must be good news coming!). Over in Italy, the Italian government pulled a €816 million gift to the city of Rome, which now faces bankruptcy or the unhappy choices of cutting public services or raising taxes. The mayor, Ignazio Marino, so far refuses to make such sad decisions. Detroit, Italian style. Volvo on the other hand is cutting another 2,400 jobs in an attempt to improve profitability.

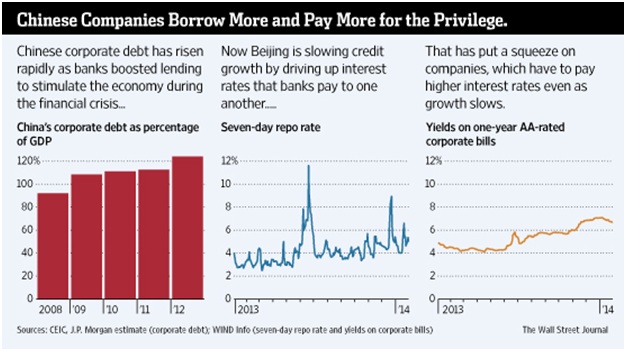

Slow Boat to China: The economic slowdown that has been hinted at for months has finally showed some symptoms. A heavily indebted coal miner Liansheng filed for restructuring due to $821 million of debt coming due on six trust products. The deal will put $4.6 billion of bad debt on the balance sheets of sponsoring banks while protecting the principal of the investors. HSBC’s PMI index for China showed a deeper contraction reading of 48.3 in February, down from 49.5 in January. While not the official factory index for the country, the HSBC measure covers more small and medium-sized businesses. At the same time, Chinese companies have accumulated $12.1 trillion in debt, not far from the US firm total of $12.9 trillion. Keep in mind that China has 55% of the US GDP ($9.2 trillion versus $16.8 trillion) so the ratio of indebtedness is higher.  As an example of rising rates, Evergreen Holding (a shipbuilding firm) paid 4.64% in June 2012 for a one-year loan, but 6.13% in February 2013. Credit is being tightened informally by China Development Bank which per the FT has asked “several” international clients to not draw on their lines of credit and the Export-Import Bank of China apparently is pushing more international borrowers into bankruptcy to collect on seized assets and clear debts. The government allowed the first corporate bond default as solar cell maker Shanghai Chaori Solar Energy Science & Technology could not make their annual interest payment of $14.6 million. Their $160 million dollar bond is small versus the $12.1 trillion debt market, but a worrying sign in a strategic industry that the bankruptcy is going forward.

As an example of rising rates, Evergreen Holding (a shipbuilding firm) paid 4.64% in June 2012 for a one-year loan, but 6.13% in February 2013. Credit is being tightened informally by China Development Bank which per the FT has asked “several” international clients to not draw on their lines of credit and the Export-Import Bank of China apparently is pushing more international borrowers into bankruptcy to collect on seized assets and clear debts. The government allowed the first corporate bond default as solar cell maker Shanghai Chaori Solar Energy Science & Technology could not make their annual interest payment of $14.6 million. Their $160 million dollar bond is small versus the $12.1 trillion debt market, but a worrying sign in a strategic industry that the bankruptcy is going forward.

The Q4 2013 GDP growth rate for Japan continued to slow with the country increasing 0.7% annualized, about 1/3rd the level predicted by the economists surveyed. In fact the +0.7% gain is a revised number from the disappointing +1.0% number originally announced. Instead of Abenomics lighting a fire under the faltering economy, the monetary injections appear to be losing their power. The Bank of Japan in a desperation move extended two corporate loan guarantee programs that are designed to keep banks lending to businesses. The low cost of funds will be taken up but is expected to simply displace other (more expensive) sources of capital. And the increase in the consumption tax (sales tax) from 6% to 8% is closer with April just around the corner. Australia has been taking it on the chin with the slowdown in industrial metals prices as well as their extended drought limits their agricultural and livestock export opportunities. Australian unemployment hit a ten-year high of 6% in January as national airline Qantas is to shed 5,000 jobs (15% of its workforce) on spiraling losses and Toyota is going to shut all production in Australia at a cost of 2,500 positions by 2017 due to a shrinking auto parts industry and a pending trade agreement with Japan that would allow viable imports to replace the production. Alcoa is shutting an aluminum smelter and two mills for a loss of 980 jobs as additional blows. Thailand threw in the towel and will end its rice subsidy that cost it approximately $4 billion. During a wobbly time of political unrest, Thailand may have to dump the rice on the market, which would crush prices given that the stockpiles of 10-15 million tonnes are equal to about half of the total world trade value in rice.

Chilly Days on the Farm: Net farm income is expected by the USDA to fall 27% in 2014 as prices for the nation’s biggest crops, corn and soybeans, are to fall by more than the increase in volume from the large harvest last and this year. A five-year low in prices makes sense also in the context of high if not record production in Brazil and a apparent slowdown in demand by China in 2014. Record export values are still expected, including a new high of $25 billion worth of agricultural products to China, but with no drought forecasted at this stage in the US, it could be another record year for crop production and a weighing on prices in the future.  Argentine farmers are trying to time their selling of soybeans as the plummeting Peso renders their crop more valuable while another harvest is due to start in April. As one can see in the FT graphic to the right, the projected build in inventories comes as soybeans become an inflation hedge for the farmer. Only 6% of the crop has been sold so far compared to 11% same time last year and 25% same time in 2012 per Macquarie. The unrest in the Ukraine has sparked rallies in Wheat and Corn but so far the protests have not materially impeded exports as the Crimea is not geographically located on the shipping routes. While Arctic breezes froze North America in February, the rest of the world enjoyed record warmth – in fact, January was the fourth warmest on record from a global perspective. Europe has been so balmy that UK gas consumers should see 10% cuts in their bills and continental Europe has stockpiles in place to dampen the volatility of the Russian natural gas that has to be transshipped through Ukraine. One should not be blasé about the squeeze that Russia’s Gazprom is putting on Ukraine to pay up $1.9 billion owed on natural gas shipments, but there is some time to try to deal with the problem (How does that shutdown of nuclear power plants look now Germany? Still a good idea?). At least Abe is backtracking from permanently shutting down Japan’s nuclear power plants as he recognizes that the high cost of liquefied natural gas is crippling their trade balance.

Argentine farmers are trying to time their selling of soybeans as the plummeting Peso renders their crop more valuable while another harvest is due to start in April. As one can see in the FT graphic to the right, the projected build in inventories comes as soybeans become an inflation hedge for the farmer. Only 6% of the crop has been sold so far compared to 11% same time last year and 25% same time in 2012 per Macquarie. The unrest in the Ukraine has sparked rallies in Wheat and Corn but so far the protests have not materially impeded exports as the Crimea is not geographically located on the shipping routes. While Arctic breezes froze North America in February, the rest of the world enjoyed record warmth – in fact, January was the fourth warmest on record from a global perspective. Europe has been so balmy that UK gas consumers should see 10% cuts in their bills and continental Europe has stockpiles in place to dampen the volatility of the Russian natural gas that has to be transshipped through Ukraine. One should not be blasé about the squeeze that Russia’s Gazprom is putting on Ukraine to pay up $1.9 billion owed on natural gas shipments, but there is some time to try to deal with the problem (How does that shutdown of nuclear power plants look now Germany? Still a good idea?). At least Abe is backtracking from permanently shutting down Japan’s nuclear power plants as he recognizes that the high cost of liquefied natural gas is crippling their trade balance.

The Spanish oil company Repsol accepted $5 billion in compensation for the expropriation of their subsidiary by the Argentine government. Of course, the payment is not in hard currency, but in the form of Argentine bonds yielding 7% to 8.75%. The Argentine government is supposed to make up any shortfall in case the value of bonds falls but in such a time of crisis, they may claim to not have the wherewithal. Gold held firm above $1320 per ounce at the end of February, up about 10% year-to-date. A lower US dollar and the Ukrainian crisis have been supportive lately though Asian consumption has not picked up yet. In banking news, Industrial and Commercial Bank of China is vying for DeutscheBank’s position on the UK gold fixing board after paying $765 million for a 60% controlling interest in Standard Chartered Bank’s market trading division. While there have been a number of scandals and fines paid in relation to various price setting groups (LIBOR, foreign exchange), China’s position as the largest gold producer and consumer makes a Chinese bank an obvious candidate. Barclays Bank meanwhile is shutting down its US and European power trading operations, after numerous staffing issues and being charged a $470 million fine for US energy market manipulation. Speaking of energy, Tesla is enjoying a doubling of Q4 2013 revenue versus the same quarter in 2012 and leveraging its positive press to issue a $1.6 billion convertible bond to start building a $5 billion battery factory with production to begin in 2017. Panasonic, the current battery supplier, is considering contributing to the project, which would double today’s global production of all lithium-ion batteries.

Invest wisely!

David Burkart, CFA

Coloma Capital Futures®, LLC

Special contributor to aiSource

Additional information sources: Bloomberg, Financial Times, South Bay Research, United ICAP, and Wall Street Journal.

[1] Apologies to President Theodore Roosevelt, but I am currently enjoying Doris Kearn Goodwins’ The Bully Pulpit: Theodore Roosevelt, William Howard Taft, and the Golden Age of Journalism – I recommend it to you history buffs and anyone interested about the (ongoing) battle between popular and corporate /entrenched power in America.