The mixed economic messages continued with our reiteration that one should expect multiple attempts by various governments to boost “good news” to try to overcome the sagging holiday shopping (despite the super-hyped Thanksgiving sales flop), fiscal tomfoolery by entities ranging from Detroit to Greece to Chinese banks and nervous financial markets that are looking out for coal in their stockings. Pessimistic exuberance may be a good description of current market behavior – extraordinary confidence that all will turn out alright but strangely anxious in being so. I suspect that this is due to investors believing that they need to put money to work to keep up with the indices but also keeping an eye on the exit if the markets really get into trouble. While some may be successful in this, not everyone can be. If there was a definition of a bubble, this is it – a heedless seeking of profits but needing a rapid unwinding of positions. Again, I do not believe that there will be a great crash this December as I believe that there will be no tapering at the next Federal Reserve meeting and that a US government budget deal will most likely be reached. However, civil unrest in Thailand (remember 1998 anyone?) or Ukraine are just as likely to cause a run on the market as the desire to book profits before year-end. Ho, ho, ho!

“If Tetris has taught me anything, it’s that errors pile up and accomplishments disappear.” – Unknown

If optimism was the only requirement to generate an economic recovery, the US would have been posting GDP growth numbers such as the +3.6% seen for the revised Q3 US GDP (up from the initial +2.8%) for the last many years. While a nice boost versus the +2.5% final number for Q2 2013, both the initial and revised numbers had inventory growth as the key contributor, rather than consumption or investment. If an enormous holiday shopping season was in the making, then such a buildup would be prescient. However, if the Thanksgiving weekend numbers are any indication, the shopping season could go either way – it may be positive but there is a real possibly of a decline as total spending for the four-day Thanksgiving period was estimated down -2.7% to $57.4 billion per the National Retail Federation. The question is more about retailing profitability as stores face the quandary of marking down prices in order to move inventory. Perhaps the OECD was right when it lowered global growth forecasts – the 2014 US GDP was reduced 0.3% to +2.9%, below the current Q3 2013 number. At least the factory production indices for the US are showing good results, which may have contributed to the upward Q3 GDP revision. Durable goods orders had a decline but anecdotally there is still chatter about “re-shoring” jobs back to the US. However, Lockheed announced layoffs covering 4000 positions across the country, generally connected with the expected and completed government defense spending cuts.

Speaking of sequestration, the rumor mill is running overtime that a federal budget agreement will scrap the planned 2014 cuts in exchange for smaller cuts and tax increases. Negotiators have until December 13th but a number of key items under review include offsetting defense spending cuts and whether to end the extended unemployment benefits which expire on December 31st unless renewed, affecting 1.3 million people. A partial reduction in Obamacare fees is also on the table, further undermining its fiscal standing. Intended to help offset the subsidies for insurance received under the exchanges, the fee in question is opposed by those that offer the old-style insurance plans i.e., unions, businesses and health insurance companies. Basically, the fee is opposed by everyone who buys health insurance not on the exchanges (about 53% versus 15% of the population – the rest are on government programs). Also, the US Treasury is looking to sell its remaining 31.1 million shares in General Motors in December (now finished at the time of writing) to lock in a $10 billion loss and move on from that part of the TARP saga (note that taxpayers still own 75% of the GM spin-off Ally Bank which has a net loss-to-date of $3 billion). A federal judge has allowed Detroit to file Chapter 9 bankruptcy, opening up massive cuts to bondholders and pensioners. Next steps see the city’s emergency manager looking to restructure the $18.5 billion in long-term debt and repudiate the $3.5 billion owed the pension plan; his restructuring plan is expected by January 9th. The ramifications will be felt throughout 2014 and beyond as Puerto Rico and the California city of San Bernardino now have legal precedent supporting their cases for bankruptcy. Illinois may also consider that direction at some point, though the state government recently passed legislation attempting to deal with its pension problems.

Looking at bankruptcy, the stories of low-quality debt and suspect structures being issued are accelerating. In the Financial Times alone, there were at least nine stories of such ilk in the last thirty days. Some sample headlines: “Citi is marketing an unusual slice of synthetic CDO to investors,” “Yield-hungry US banks gorge on ‘sliced and diced’ securities,” “Triple C bond sales hit record high” and “Junk borrowers rush to beat Fed.” Another story highlighted record sales of convertible bonds that pay no interest and are sold at no discount to par – AKA “no-no” debt. Yahoo sold $1.25 billion and ServiceNow (an IT management software firm) sold $575 million of these securities in November. Covenant-lite loans (debt with minimal if any protections for creditors) have hit record levels of $64 billion so far this year, causing bond managers to take on more default risk. With Yellen’s confirmation vote expected the second week of December, the market will be watching the 17th and 18th to see if there will be any tapering of the Federal Reserve’s bond purchases. Despite some of the better economic data in the last few weeks, I believe that there will be no taper as the unemployment rate threshold of 7.0% just opens up the consideration of tapering and a level of 6.5% is the true taper marker. To be clear, I do think that the Fed should not be purchasing bonds at all as interest rates are too low but the political pressure to keep the debt costs down and to look like the government is “doing something” means that the Fed will likely follow the President and Congress’ desires and keep up substantial buying into 2014.

“I’m a pessimist because of intelligence, but an optimist because of will.” – Antonio Gramsci

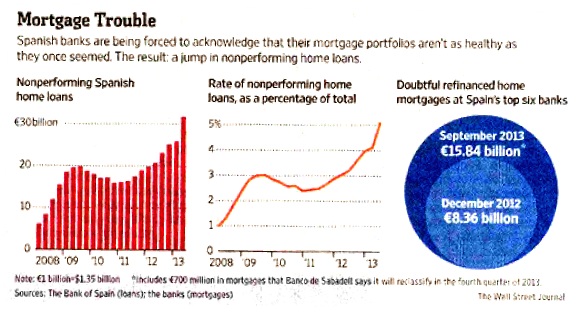

The Eurozone countries also got an OECD downtick of -0.5% in their 2014 GDP estimates to put them at +1.0% next year. The UK was shifted upwards by +0.6% to +2.4% so not all is gloom on that side of the pond. Although quiet into the holiday season, there are still signs of economic tension. On the government debt side, the Netherlands lost its AAA rating from Standard and Poor’s, leaving only Germany, Luxembourg and Finland in the top tier. S&P also hit France’s rating by one notch to AA earlier in the month. Cyprus however was upgraded to B- from CCC+  so time to celebrate! Portugal swapped €6.6 billion of debt coming due in 2014 and 2015 for later maturities, reducing the amount of additional money it needs to raise in 2014 from €14 billion to €11.5 billion as well as modestly reducing the associated interest costs. Spain on the other hand is playing more games with its banks – allowing them to reclassify deferred tax assets into tax credits which increased their regulatory capital before the European stress tests next year. With higher capital, Spanish banks would appear healthier, even if nothing has changed in reality (sound familiar?). This is coming at a time when Spanish banks are more suspect in not having realized the mortgage losses associated with a population that is 26% unemployed. A doubling of doubtful refinanced home mortgages in nine months is very suspicious. It looks like the old “extend-and-pretend” game where the bank extends the loan and pretends that the developer or home owner still has the ability to pay back the principal. Peugeot is looking at closing one of its production lines to cut costs and employment – looks like news for next year. Perhaps that type of delay is why France could claim a drop in unemployment for the first time in April 2011, although the total 3.27 million unemployed is still close to the record.

so time to celebrate! Portugal swapped €6.6 billion of debt coming due in 2014 and 2015 for later maturities, reducing the amount of additional money it needs to raise in 2014 from €14 billion to €11.5 billion as well as modestly reducing the associated interest costs. Spain on the other hand is playing more games with its banks – allowing them to reclassify deferred tax assets into tax credits which increased their regulatory capital before the European stress tests next year. With higher capital, Spanish banks would appear healthier, even if nothing has changed in reality (sound familiar?). This is coming at a time when Spanish banks are more suspect in not having realized the mortgage losses associated with a population that is 26% unemployed. A doubling of doubtful refinanced home mortgages in nine months is very suspicious. It looks like the old “extend-and-pretend” game where the bank extends the loan and pretends that the developer or home owner still has the ability to pay back the principal. Peugeot is looking at closing one of its production lines to cut costs and employment – looks like news for next year. Perhaps that type of delay is why France could claim a drop in unemployment for the first time in April 2011, although the total 3.27 million unemployed is still close to the record.

It should be of no surprise that in this shaky environment that the ECB unexpectedly cut rates to a record low. Draghi finally matched Bernanke, reaching 0.25% five years after the Federal Reserve moved to that level. At some point, Draghi will realize that such minimal rates did not do us any good and it will not help Europe either. Europe’s crisis may not come from the Eurozone but from Ukraine or Russia. Russia again cut GDP growth forecasts for 2013, 2014 and 2015 to about half the levels a year ago, to +1.4%, +2.5% and 2.8% respectively. Russia’s central bank also warned about consumer lending, which went up 36% during the first nine months of 2013 and non-performing loans also moving up during the same period from 5.9% to 7.7%. Maybe that is part of why Putin is playing hardball with the Ukraine, blackmailing its government into rejecting its planned European Union integration and to stay within the sphere of Soviet Russian economic and energy dependence. With a need for oreign currency, interest rates are moving up on Ukrainian debt as fewer western lenders are willing to front the money to cover its cash shortages. Sadly, a deal with Chevron that would reduce the country’s dependence on Russian natural gas by exploiting Ukrainian shale gas is in jeopardy thanks to Russian strong-arming. A potential crisis is in the making.

People only accept change in necessities and see necessities only in crisis. – Jean Monnet

Again leading off with the OECD GDP estimates, China’s 2014 growth was cut by -0.2% and India’s by -1.7%, though Japan was revised up by 1%. I guess that someone believes that Abenomics will carry the country through the planned increase of the sales tax in April 2014 from 5% to 8%. Obviously in the months leading up to that date there will be a spike in consumption as consumers accelerate purchases, but the impact on the rest of the year should be negative. In addition, Japanese GDP for Q3 2013 slowed down to +1.9% annualized, a marked decline from the +4.3% and +3.8% numbers for Q1 and Q2. Lower exports and consumption, hurt by rising energy costs were blamed. China, on the other hand, saw a nice increase in exports in October at +5.6%, higher than the 3.2% expected. The challenge of November is the increase in Chinese bond yields to the highest in nine years (over 6% yield for five-year government debt) as the government tries to rein in the explosion in money supply that we have outlined time and again in these commentaries. Somewhat counter to this decision is the Chinese government move to allow Singapore-based investors to buy up to Rmb 50 billion ($8.2 billion) in renminbi-denominated securities (i.e., domestically-issued stocks, bonds and money market products). With Singapore the third-largest foreign exchange hub globally and a direct rival to Hong Kong financial markets, this further incrementally internationalizes China’s financial markets. Thailand was rocked most of November by riots and strikes by opposition to the ruling party. Though the news at this writing is that calm has returned, memories of 2010 strife that left about 90 dead are in the back of people’s minds. And recall that last commentary we reported that Thailand wants to raise $15 billion in new debt. Will investors be comforted by blood in the streets? Indonesia just failed to sell US dollar-denominated bonds to local investors – it wanted to sell $450 million but could only find demand for $190 million of the 3.5% coupon notes that mature in 3.5 years. Although having more US dollars on hand would give the government more flexibility in covering its foreign-exchange deficit, burning through the dollars could tip the government into crisis as it would not have many options to raise money thereafter apart from default. And that would bring up the 1997 Asian contagion crisis again.

What is the United States largest dollar based export? Refined Products.

The refining industry has surpassed Boeing as the No. 1 export of the U.S. – John Knock of Macquarie Energy

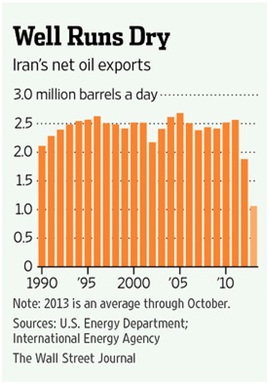

Iran was the big news for November in the oil markets with a temporary deal bringing modest relief to sanctions. We shall see if something still stands in six months but Iran is already courting western oil companies to consider exploration / production… maybe it is just me, but that sounds like the cat trying to lure the rat with a piece of cheese. Total, Shell, Eni and Statoil all pulled out in the 1990s due to unattractive oil contracts and sanctions. Given the treatment of oil companies by populist dictatorships in South America (Argentina and Venezuela to point to recent examples), it seems like a risky financial and political proposition to me. Libya continued to face production issues due to political unrest – various protestors and groups have been blocking oil production, transportation and refining facilities off and on for the last six months. The weak central government has been unable to secure 60% of the high-quality crude oil badly needed for export. Perhaps it is a good thing that Europe is suffering through an economic malaise. In the meantime, Saudi oil exports were at eight-year highs of 7.84 million barrels per day as domestic usage fell 5% in Q3 2103 versus Q3 2012. The United States also hit a production milestone, extracting more oil than imported for the first time in eighteen years. Falling gasoline prices in the US I believe have had an outsized effect on keeping the economic recovery going (such as it is). Meanwhile Brazil’s Petrobras, the government-run oil company, continues to erode shareholder value as it dances around increasing gasoline and ethanol prices to match costs. Brazilian inflation at 6% is kept in line partially because of government-directed subsidized oil prices, in case there are any supposed bargain hunters out there. Perhaps tactics like this caused Brazilian Q3 GDP to fall 0.5% for the quarter (not annualized).

Iran was the big news for November in the oil markets with a temporary deal bringing modest relief to sanctions. We shall see if something still stands in six months but Iran is already courting western oil companies to consider exploration / production… maybe it is just me, but that sounds like the cat trying to lure the rat with a piece of cheese. Total, Shell, Eni and Statoil all pulled out in the 1990s due to unattractive oil contracts and sanctions. Given the treatment of oil companies by populist dictatorships in South America (Argentina and Venezuela to point to recent examples), it seems like a risky financial and political proposition to me. Libya continued to face production issues due to political unrest – various protestors and groups have been blocking oil production, transportation and refining facilities off and on for the last six months. The weak central government has been unable to secure 60% of the high-quality crude oil badly needed for export. Perhaps it is a good thing that Europe is suffering through an economic malaise. In the meantime, Saudi oil exports were at eight-year highs of 7.84 million barrels per day as domestic usage fell 5% in Q3 2103 versus Q3 2012. The United States also hit a production milestone, extracting more oil than imported for the first time in eighteen years. Falling gasoline prices in the US I believe have had an outsized effect on keeping the economic recovery going (such as it is). Meanwhile Brazil’s Petrobras, the government-run oil company, continues to erode shareholder value as it dances around increasing gasoline and ethanol prices to match costs. Brazilian inflation at 6% is kept in line partially because of government-directed subsidized oil prices, in case there are any supposed bargain hunters out there. Perhaps tactics like this caused Brazilian Q3 GDP to fall 0.5% for the quarter (not annualized).

Following up on the tension between Russia and Ukraine, Russia’s natural gas export company Gazprom demanded that Ukrainians pay $882 million in overdue natural gas bills, which formed the basis for the blackmail of keeping Ukraine out of the European Union. And this is a cold winter too in Europe, tightening the screws on this country trapped between East and West Europe. Not as if the alternatives are very attractive – next year the estimated cumulative amount that Germans have spent on alternative fuels is €100 billion – 25% of their electricity is wind and solar but households are paying double what they used to.

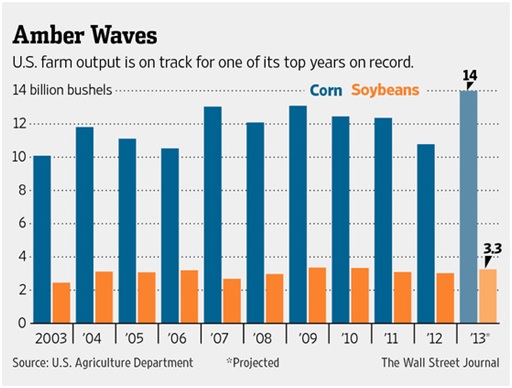

Just in case there was any question about this year’s crop, it was a good one, although shy of expectations. Stockpiles (AKA carryout) is also projected to be lower than first hoped, keeping prices off their lows. Demand from China is the first choice  though questions on South American logistics also plague their ability to meet demand. US corn cargos also have been rejected from China recently as they consist of a non-acceptable GMO strain. I suppose someone did not think that the Chinese would notice. Here in the US, the Food and Drug Administration moved to ban trans fats in one of first rulings that has taken a food product out of “generally considered safe” category, which means that there were no limitations or restrictions on its use (for those interested, GMO versions of foods are also by definition “generally considered safe.”). First used in the 1900s, the elimination of trans fats is estimated by the FDA to eliminate 20,000 heart attacks and 7000 deaths per year. For those interested in consuming trans fats, the Long John Silver’s fast food chain is said to have some of the highest concentrations, at least until the end of the year.

though questions on South American logistics also plague their ability to meet demand. US corn cargos also have been rejected from China recently as they consist of a non-acceptable GMO strain. I suppose someone did not think that the Chinese would notice. Here in the US, the Food and Drug Administration moved to ban trans fats in one of first rulings that has taken a food product out of “generally considered safe” category, which means that there were no limitations or restrictions on its use (for those interested, GMO versions of foods are also by definition “generally considered safe.”). First used in the 1900s, the elimination of trans fats is estimated by the FDA to eliminate 20,000 heart attacks and 7000 deaths per year. For those interested in consuming trans fats, the Long John Silver’s fast food chain is said to have some of the highest concentrations, at least until the end of the year.

In industrial metals, mining giant Rio Tinto is expanding its flagship iron ore operations in Australia, although planning to spend $3 billion less than expected. The expected demand from China is behind the move. The lower spending may be showing up in equipment maker Caterpillar, as global sales of machinery are estimated down 12% for the three months ending October 31st. In precious metals, Chinese gold imports surged to the second highest amount ever – 148 tons in the month of October. Silver coin demand in the US also moved to a record high in 2013, 40 million ounces so far. It seems that someone is bottom fishing at recent prices! Meanwhile, Venezuela borrowed $1.68 billion against gold collateral in order to gain access to needed hard currency as it only has $2.5 billion in reserves. Since the late Hugo Chavez was an avid gold collector, including repatriating the metal to his country to safeguard it against US and UK governments, one can only conclude that their economic situation is grim.

Invest wisely!

David Burkart, CFA

December 10, 2013

Additional information sources: Bloomberg, Financial Times, New York Times, South Bay Research, United ICAP and Wall Street Journal.