With the S&P 500 up +3%, we reversed the equity market’s loss of August, which was a reversal of the gain in July. Uncertainty in Washington is the favored reason for this sideways trade, though anyone paying attention to the US political-fiscal situation knew that the budget / debt-limit battle was building since the spring.[1] Obviously, there were interim distractions: sequester, Detroit, Fed taper talk, Middle East, global economic slowdown. But in the end, the large deficit and certain programs (e.g., Obamacare) were in the crosshairs of certain take-no-prisoner Republicans and were correspondingly supported by particular hold-the-barricades Democrats, including the President whose signature is effectively required to get any budget passed. With the US government not funding certain programs since the middle of May (e.g., US federal employee pensions), the estimated deadline of reaching a blatant fiscal shortfall is rapidly drawing near – as in approximately the week after this commentary is to be published. Will there be a “grand bargain” or a grand explosion? The cynical outcome points to a grand mush that pushes the problem to later (and makes it larger in the meantime). Meanwhile, the rest of the world is meandering along – Greece is looking to renegotiate its handouts from the EU, China’s economy is not as crummy as everyone thought (but not as great either) and the grain-growing countries are having a quite decent harvest in row crops. Perhaps when the US federal government comes to a temporary ceasefire, the rest of us can focus on these fundamentals for awhile.

Loosening the Belt(way): The chatter on the budget is all about how tight it is going to be, losing sight that the proposed $700-750 billion deficit is #6 in terms of the dollar size and #18 in terms of percentage of GDP (counting the 69 fiscal years after WWII).[2] Therefore, while the two items (the annual budget and the limit on US debt) are technically separate, the two are effectively linked. With the President proposing a $744 billion deficit in his budget, debt ceiling increases of $1 to $2 trillion are needed to avoid this pile-up in the near future (still means that Obama will likely face it again before his term is up though and that it will also be Presidential election issue). The debt held by the public as a percentage of GDP will continue to increase from its historically high 73% to hit 77%. Note that the Federal Reserve does not alter that trajectory[3] despite buying at a pace that will absorb most of the new issuance, assuming it does not taper its purchases. Of course, with the federal government not publishing economic data for the last six days, the Fed may not taper anyway in its upcoming meeting on October 29th and 30th because it could claim that it cannot properly measure the economy. Also, the US is running out of “extraordinary measures” to temporarily trim spending as the debt limit has not been raised since May 19th. Effectively, the US government has to expand its prioritization of payments, leaving more out in the cold – perhaps defense contractors, bondholders, summit planners (sorry Asia! Bet APEC was great!). We do it in California all the time – IOUs against future tax revenue – when our state comes up short. Why not the Feds? In looking at the future, with revenues up +13% (+$284 billion eleven months into the fiscal year)[4] and expenses down -3.9% (sequester, Defense, etc. though Medicaid was up +6.1%), any more taxation / spending adjustments to our country’s unsustainable fiscal path will be even more nastily fought over. Something to look forward to.

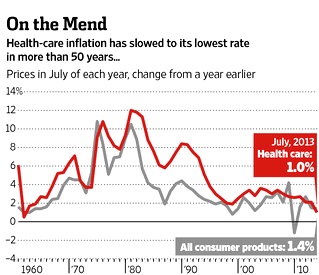

On the US economic side, there was not much news, even before the government went dark on its reporting. Retail sales grew 0.2% in August, the slowest since April. The housing market also made a last hurrah as increasing mortgage rates in the last few months have started to dent purchasing power, knocking back the leverage associated with a $1000 monthly payment from about $225,000 in home purchase price to $195,000. Home sales and prices were up in July and August respectively as home buyers rushed to beat these higher interest rates. However, August saw a decline in existing home sales as the higher mortgage costs took hold. On the eve of Obamacare, the US Commerce Department reported that health-care inflation rose at the lowest rate in fifty years – even below overall inflation (see WSJ graph at right).  Greater availability of generic drugs, internet search use for medicines and more aggressive medical cost containment were attributed to holding back costs. This does not fully address the total medical spending costs in the US – while per-unit costs may not be increasing by a lot, the increasing amount of medical care due to poor diet, over-testing, etc., is still expected to push total medical care costs significantly higher both in relative and absolute terms. Separately, in September, the US Census Bureau reported that the median household income stabilized in 2012 at $51,017 after hitting the pre-recession peak of $55,627 in 2007 (note that the all-time high was in 1999 at $56,080). Stabilized in this context means year-on-year not falling more than what is statistically significant, so the decline may continue next year depending on the percentage of part-time employment, fiscal and monetary policy and many other factors. It should be noted that behind the numbers, the top 1% of employees made 20% more than the previous year and also older workers tended to have slight income gains, while under 25-year-olds had 1.6% less income vis-à-vis the year prior. In raw employment news, Merck announced 8500 job cuts in the next two years in addition to the 7500 already announced as the firm trims back to its employment levels before the Schering-Plough acquisition. Yes, they bought a name-brand pharmaceutical company and eliminated all the jobs associated with that firm over the course of six years. In the world of IT, Alcatel-Lucent announced a 20% workforce reduction of about 10,000 workers worldwide, including 2200 in the Americas as telecom infrastructure build-out continues to slow.

Greater availability of generic drugs, internet search use for medicines and more aggressive medical cost containment were attributed to holding back costs. This does not fully address the total medical spending costs in the US – while per-unit costs may not be increasing by a lot, the increasing amount of medical care due to poor diet, over-testing, etc., is still expected to push total medical care costs significantly higher both in relative and absolute terms. Separately, in September, the US Census Bureau reported that the median household income stabilized in 2012 at $51,017 after hitting the pre-recession peak of $55,627 in 2007 (note that the all-time high was in 1999 at $56,080). Stabilized in this context means year-on-year not falling more than what is statistically significant, so the decline may continue next year depending on the percentage of part-time employment, fiscal and monetary policy and many other factors. It should be noted that behind the numbers, the top 1% of employees made 20% more than the previous year and also older workers tended to have slight income gains, while under 25-year-olds had 1.6% less income vis-à-vis the year prior. In raw employment news, Merck announced 8500 job cuts in the next two years in addition to the 7500 already announced as the firm trims back to its employment levels before the Schering-Plough acquisition. Yes, they bought a name-brand pharmaceutical company and eliminated all the jobs associated with that firm over the course of six years. In the world of IT, Alcatel-Lucent announced a 20% workforce reduction of about 10,000 workers worldwide, including 2200 in the Americas as telecom infrastructure build-out continues to slow.

In financial markets, the big news was Ben Bernanke took the taper off the table at the September Federal Reserve meeting. As we predicted last newsletter, the Fed’s guidelines with respect to employment to reduce purchases of US government and mortgage-backed securities were not yet reached and so despite the market hype and hand-wringing, the taper did not happen. Now with the government shutdown halting most economic announcements, the Fed again will likely not taper at the upcoming meeting due to a lack of data as well as no obvious vast improvement in employment. Also in Fed news is that Lawrence Summers officially bailed out of the race to replace Bernanke, leaving the field clear for Yellen’s enthronement without much delay. Again, she is a monetary dove, which means that she is likely to wait as long as possible before tapering – assuming she does so. Given that bond buying by the Federal Reserve only adjusts the timing as to when US government interest rates increase and thus is only fundamentally optics, my question is whether she will be able to push that interest rate increase to her successor as Bernanke has kindly done to her. Banks generally are cutting staff with the slower existing home sales cited above – JP Morgan, Bank of America, Wells Fargo and Citigroup have cut 10,000 mortgage-related jobs this year with plans for thousands more as both the refinancing as well as origination businesses dry up with higher interest rates. While the TARP bailout continues to hang over General Motors, it did receive a bond rating upgrade by Moody’s to investment grade, the first of the rating agencies to do so. The upgrade was in connection with its first unsecured bond issuance since the TARP bailout and is designed to buy out high-cost preferred stock owned by its union. Finally in the world of muni debt, Puerto Rico looks to be in financial trouble and wealth advisory firms from UBS, Wells Fargo and Raymond James have been restricting their clients from buying its $70 billion of debt (equal to about 2% of the muni bond market). With a budget deficit of over $1.3 billion and unfunded pension liabilities totaling 91%, the commonwealth may be worse off than Detroit! And who bails them out? The Federal government? Puerto Rico is not a state technically so what is the law that covers this situation? More fumbling in the dark.

Ignore Us Europeans Over Here: While the loud Americans hang out their dirty laundry for all to see, the Europeans are quietly trying to brush their slow-burn crisis under the rug. Greece is a good place to start as the country began talks with the troika (EU, ECB and IMF) for a third multi-billion Euro bailout. Fortunately, the needed funds will be significantly smaller than the €240 billion already pledged – €15 to €20 billion may be reasonable placeholders for now. With the Greek government needing to cut billions more in spending, this “last” bailout may be only latest – and which politician want to face the heat? Even Merkel would have to put on a major selling effort. One quick way to save cash is the elimination of six paid holidays that Greek civil servants get for having to use a computer. Yes, the two-decade-long “computer leave” is a bonus for public employees that use a computer for five hours a day. Don’t worry, the public union struck to keep the privilege and promised to fight the decision in court.

In other countries, a host of efforts were made to try to deal with ongoing fiscal problems. Sweden cut taxes to try to stimulate growth, Russia plans to cut spending and raise taxes (AKA austerity – maybe if they stop supporting Assad in Syria that would save them money – or they should try to get the Iranians to pay for it), the Ukraine is struggling under higher deficits (budget and trade), dwindling foreign reserves and debt coming due, the Italian government almost toppled under Berlusconi’s latest power play (though that seems behind us now), a slowing economic recovery is causing France to rethink its higher planned taxes though the deficit is rapidly growing and government spending is the highest percentage of GDP in twenty years (just under 57%) and Poland is planning to confiscate government bond holdings in private pension plans (~$38 billion) and replace them with an interest in the public pension system, cutting the official public debt by -8% to 55% of GDP (of course it is an optical illusion, replacing a transparent liability with a hidden one). In one bit of good news, Moody’s upgraded Ireland’s rating outlook from “negative” to “stable,” though still with a junk rating (it is the only rating agency with a non-investment grade mark for Ireland). Actually, only three countries have a “stable” rating from Moody’s: Ireland, Finland and Estonia, so that outlook is a distinction.

Mixed News in Asia: Well, on the plus side, Japan has the 2020 Summer Olympics to look forward to! However, the 2014 event is the increase in the sales tax in April by 3% to 8%. Prime Minster Abe also announced a ¥6 trillion ($62 billion) stimulus plan of cash handouts and corporate tax breaks to partially offset the ¥8 trillion tax increase. Besides this projected austerity, Japan’s current-account surplus collapsed to a record low for August as overseas income dropped for the first time in nine months and the trade balance stayed in deficit. China posted some positive numbers recently (industrial output up 10.4% YoY in August, higher housing prices, higher exports (up 7.2% YoY in August) but increases in wages and a stronger currency threaten those gains. Some also question the sustainability of these gains as debt-to-GDP continues to grow and government spending seems to drive the shinier numbers. Competitor Taiwan continued its export recovery with a 3.6% YoY increase in exports. In fact, manufacturing sentiment as measured by the PMI data show improved output potential in most Asian countries in September. However, Indonesia, a large raw materials exporter to China, has slowing GDP growth and has a fragile currency after the Federal Reserve’s taper tantrum, causing the central bank to raise its benchmark and money market interest rates again in September. We reported last month on its dwindling foreign exchange reserves as the country’s trade deficit forces it to attract foreign bond investors . This reminds me of the contagion issues of the Asian financial crisis back in 1997. The good part is that it created some excellent buying opportunities.

. This reminds me of the contagion issues of the Asian financial crisis back in 1997. The good part is that it created some excellent buying opportunities.

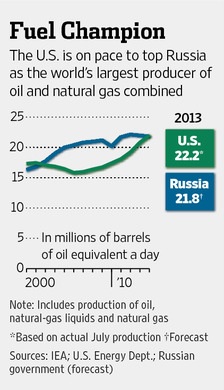

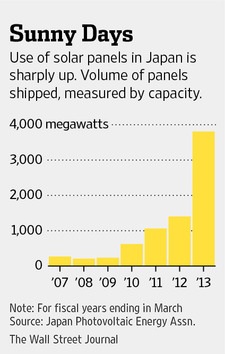

US Beats Russia: Not in hockey but in total energy production per US and Russian government estimates. As one can see in the graph to the right that this used to be the case at the turn of the century but as Russia pushed expansion, it pulled ahead until the recent shale boom in oil and natural gas took the US forward. Both countries produce both oil and natural gas, which puts them well ahead of the number one oil producer, Saudi Arabia, at number three. Saudi Arabia recently filled an important supply role as Libya, Angola and Nigeria all had production problems and Russia has been inking big export deals with China. Thanks to its ability to push production to over 11 million barrels per day, Saudi crude plays a critical swing role in the energy markets. US natural gas has been finding a home in Mexico as pipelines carry twice as much volume as they did in 2010 and new pipelines aim to double that amount by 2017. The current volume is less than 3% of US production but with natural gas futures prices still below $4, the extra demand is welcome. As the US becomes more dependent on natural gas, a recent study showed that well leakage is about 10% less than the current EPA numbers thanks to current technology. Another nail in the coal coffin is the EPA proposed carbon capture regulations on new coal plants, a technology never used before in a commercial coal power plant. One is under construction and should be running in May 2014 so we shall see if this technology will be actually feasible and if more broadly mandated. With all this uncertainty around electricity generation, there is an accelerating trend to self-generation. Since 2006, the number of electricity-generation units at commercial and manufacturing sites has more than quadrupled, with cheaper solar panels and natural gas prices leading the way. Also,  business continuity concerns around major hurricanes and other headline disasters have prompted an emotional response that reinforces this move. Japan too has jumped on this, thanks to the Fukushima disaster and the brown-outs that plagued the country subsequently. Earthquakes and typhoons also add to the need of distributed power. With the restart of the fifty nuclear reactors still unknown and high LNG import costs sapping the pocketbooks of industry and individuals alike, there is a stronger need for energy options. Funny, that is how fuel-efficient Japanese automobiles took over the world too – an invention borne out of necessity. Will this happen in alternative energy too?

business continuity concerns around major hurricanes and other headline disasters have prompted an emotional response that reinforces this move. Japan too has jumped on this, thanks to the Fukushima disaster and the brown-outs that plagued the country subsequently. Earthquakes and typhoons also add to the need of distributed power. With the restart of the fifty nuclear reactors still unknown and high LNG import costs sapping the pocketbooks of industry and individuals alike, there is a stronger need for energy options. Funny, that is how fuel-efficient Japanese automobiles took over the world too – an invention borne out of necessity. Will this happen in alternative energy too?

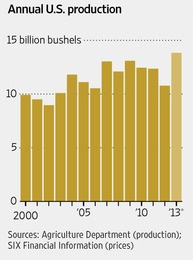

Lower grain costs seem to be in the offing as the North American harvest is in full swing. StatsCanada indicated a bumper crop in canola and wheat – with 30.6 million tonnes of wheat breaking the production record of 1990 despite having 27.5% fewer acres under plow this year. A record corn crop is expected the US, graphed below by the Wall Street Journal.  This will pressure all crops, even soybeans which have a larger crop this year but are still in relative tight supply. A larger corn crop will also allow for livestock production to increase, though that is a multiyear process for cattle. Production outside North America is also supposed to be strong. Ukrainian production is approaching 29 million tonnes – three times the amount ten years ago. This puts the country in the major league of exporters, such as Argentina and Brazil. Their first corn export deal with China is expected to leave port soon. China will need that corn to feed its hogs – the purchase of Smithfield by Shuanghui will not be sufficient to cover all of its porky desires. An alternative protein source that perhaps should be expanded is insects. Five MBAs from McGill University in Canada won the prestigious Hult prize for entrepreneurship to create and distribute grasshopper growing kits for the two billion people that regularly eat insects for protein, calcium and iron. In this way, those consumers can have access to these vital nutrients all year around, as opposed to just seasonally. You can expect your delivery by March 2014.

This will pressure all crops, even soybeans which have a larger crop this year but are still in relative tight supply. A larger corn crop will also allow for livestock production to increase, though that is a multiyear process for cattle. Production outside North America is also supposed to be strong. Ukrainian production is approaching 29 million tonnes – three times the amount ten years ago. This puts the country in the major league of exporters, such as Argentina and Brazil. Their first corn export deal with China is expected to leave port soon. China will need that corn to feed its hogs – the purchase of Smithfield by Shuanghui will not be sufficient to cover all of its porky desires. An alternative protein source that perhaps should be expanded is insects. Five MBAs from McGill University in Canada won the prestigious Hult prize for entrepreneurship to create and distribute grasshopper growing kits for the two billion people that regularly eat insects for protein, calcium and iron. In this way, those consumers can have access to these vital nutrients all year around, as opposed to just seasonally. You can expect your delivery by March 2014.

Invest wisely!

David Burkart, CFA

Special Contributor to aiSource

October 9, 2013

Additional information sources: Bloomberg, Financial Times, New York Times, South Bay Research, United ICAP and Wall Street Journal.

[1] See our April commentary for our first reference to this possibility.

[2] Source: White House Office of Management and Budget

[3] Source: US Government Accountability Office. “Debt held by the public is the value of all federal securities sold to the public, i.e., investors outside of the federal government. This debt is owed to a wide variety of investors, including international investors, domestic private investors, the Federal Reserve, and state and local governments.”

[4] Largely from individual income tax payments (front-loaded into 2012 to avoid higher taxes in 2013) and the reversion of the payroll tax back to its previous level.