As good as July was for stocks, the markets gave much of it up in August with S&P 500 down around -3% and EAFE down almost -2%. Bonds fared little better as the broad US-based Barclays Aggregate and 10-year European-wide sovereigns each lost -1% and the JP Morgan Emerging Market bond index down just shy of -3%. Indexed commodities were the clear winners at +3.4%. The equity markets seem to be primarily affected by headline risk: the Federal Reserve put tapering back on the table, Congress continued to ignore the impending debt ceiling limit, Middle East tensions took a quantum leap higher on Egypt and Syria and tight world crude oil markets threatened the nascent global economic recovery. Bonds were influenced primarily by tapering and economic recovery chatter as both implied less government support for bond prices. Passive commodities seemed the overall beneficiary to these sentiments, whether from an economic recovery growth concept or a flight-to-safety / supply concern concept. Coming into September, Syria is grabbing the headlines as the President’s attempt to build consensus for an airstrike punishment pushes off other priorities, including immigration policy, the Federal Reserve nomination process and public education on the widespread changes to the US healthcare system slated to begin October 1. If nothing else, the events in the Middle East serve as a warning that we operate in a multi-polar world and high-minded values tend to attract spoilers rather than imitators – and unfortunately, not just internationally, but also domestically.

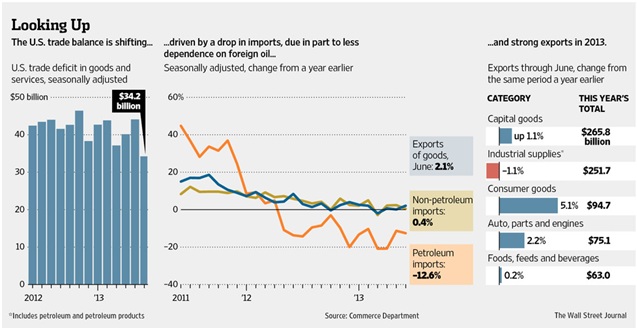

Storming Forward (Slightly): It is tough to write about the US economy’s direction with its muddling-through nature. US Q2 GDP growth was revised upward to +2.5% annualized rate from the prior +1.7% estimate and the official unemployment rate fell to 7.3%, both positive headlines. Industrial production also stayed in positive territory and the trade deficit shrunk as oil and consumer goods imports shrunk (i.e., two-year low in oil imports and fewer cell phones, if that’s possible) and record exports signaled overseas expansion.

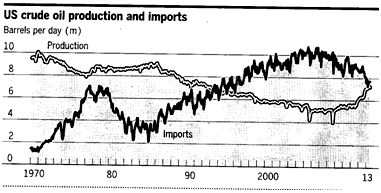

Shrinking oil imports came at a time of increasing oil demand per the International Energy Agency within the US Department of Energy, though primarily in industrial uses, not consumer. Retail sales also notched an increase of +0.2% for the fourth consecutive month of increases in July and June was revised higher from +0.4% to 0.6%, month-on-month. Borrowing also increased in auto loans, credit card balances and mortgage debt. Delinquencies of 90 days or more stand at 5.7%, the lowest level since 2008 showing that either people are paying their bills, finance companies are charging off their losses more aggressively or new loans are only going to more credit-worthy borrowers. On the negative side, the borrowing increase may be a last hurrah as increasing interest rates may have motivated consumers to lock in current rates, especially on big-ticket items such as houses and cars. Automobile sales in fact shifted into high gear as total sales of 1.5 million vehicles eclipsed the 2008 highs, though the annual pace of 16 million is still below the record in 2008 of 17.4 million. New home sales and new construction both dropped in July. Big-ticket manufactured goods production fell in July, both on the business and consumer sides. Wages and salaries paid fell in July for the first time since January, and the labor force participation rate also fell, undercutting the decrease in the unemployment rate. Job gains for June and July were reduced by 74,000 positions total and August’s came in at a moderate +168,000 pace, a 22,000 person miss as the Bureau of Labor Statistics had to correct non-farm payrolls to better align with other data. Increases in auto manufacturing have lead to only modest hiring as the Big Three are running with 15-20% smaller payrolls despite the higher production.

The US governme nt’s finances took a turn for the better with the Treasury posting the best revenue year-to-date since the recession. For the period from October 2012 to July 2013, proceeds totaled $2.3 trillion, cutting the deficit to $607 billion as spending remained at $2.9 trillion, about the same level since 2009. With the new fiscal year approaching and the new budget yet to be hammered out, Congress’ eye is on the debt ceiling of $16.7 trillion, which needs to be raised in October before the accounting shenanigans have to be applied more than usual. On a more local level, Detroit continues to upset the municipal market as its public schools sold $92 million of one-year single-A debt at yield of 4.375%, as compared to a 0.18% benchmark rate. Also in August Michigan’s Saginaw County (double-A rated) postponed a $60 million deal, as well as Genesee County to its $53 million sale and Battle Creek’s $16 million issue. Detroit’s emergency manager is looking to restructure $5 billion in water and sewer bonds, forcing other similar bonds to weaken (see left).Parallel to this drama is the California city of San Bernardino which was just allowed to declare Chapter 9 bankruptcy. Now the city can negotiate with its creditors, though since government employee pension costs account for 80% of its budget, there is essentially only one place where budget savings can come from.

nt’s finances took a turn for the better with the Treasury posting the best revenue year-to-date since the recession. For the period from October 2012 to July 2013, proceeds totaled $2.3 trillion, cutting the deficit to $607 billion as spending remained at $2.9 trillion, about the same level since 2009. With the new fiscal year approaching and the new budget yet to be hammered out, Congress’ eye is on the debt ceiling of $16.7 trillion, which needs to be raised in October before the accounting shenanigans have to be applied more than usual. On a more local level, Detroit continues to upset the municipal market as its public schools sold $92 million of one-year single-A debt at yield of 4.375%, as compared to a 0.18% benchmark rate. Also in August Michigan’s Saginaw County (double-A rated) postponed a $60 million deal, as well as Genesee County to its $53 million sale and Battle Creek’s $16 million issue. Detroit’s emergency manager is looking to restructure $5 billion in water and sewer bonds, forcing other similar bonds to weaken (see left).Parallel to this drama is the California city of San Bernardino which was just allowed to declare Chapter 9 bankruptcy. Now the city can negotiate with its creditors, though since government employee pension costs account for 80% of its budget, there is essentially only one place where budget savings can come from.

The Federal Reserve is coming up to its September meeting on the 17th and 18th, which will be closely watched for a tapering implementation, even a modest one. Since the unemployment is still above the target set out earlier in the year (at 7.3% versus the 7% level) and a new Chair has not been nominated, I see little need for an announcement to begin tapering in the near future (a distinctly minority view as most prognosticators are predicting a $10-15 billion taper starting in Q4). Inflation is also under control officially at a modest 2% annualized rate, though slightly accelerating. Foreigners apparently are not waiting for Fed as the amount sold by non-US investors reached the highest level ever of $67 billion in June (versus the previous high of $59 billion in November 2008 after the collapse of Lehman Brothers). China cut its holdings by $21 billion, though it remained the largest US government bondholder. In other banking news, Fannie and Freddie, the collapsed mortgage financing agencies, posted $15 billion in profits, largely on lower reserves against delinquencies and higher home prices. However, they are still a ways off from recovering all that they lost as well as a few years from paying off all that they owe to us taxpayers. Ally Financial, the auto-loan company spun off from General Motors, is looking to issue $1 billion in stock to partially repay the $12 billion it still has outstanding from its federal bailout (remember that this is partially why GM returned to profitability so quickly – it dumped its financing division which in turn received $17 billion in government money – more hidden government auto bailouts!). With regard to commercial banks, Wells Fargo is cutting 2,300 mortgage-related positions and JP Morgan announced that it was going to cut back its money-transfer business with foreign banks in order to put in new controls and reduce exposure to overseas market disruptions. Wells Fargo may have moved too soon as the Federal Reserve and other regulators have backtracked from rules requiring banks to hold 20% of new mortgage-backed securities – you know, of the type that blew up in 2008. Guess that bank lobbying against Dodd-Frank is bearing fruit! Poison fruit for us taxpayers, to be sure.

Is Less Bad Better? European GDP growth in the second quarter managed to reverse the -0.3% of Q1 2013 with a +0.3% quarterly rate or +1.1% annualized. It is certainly nice to post a positive number, even if questions of sustainability linger. The ECB still estimates a contraction for the year of -0.6%, though modest growth in 2014. Further, assuming historical productivity gains of 1%, there is little optimism that there will be a turnaround on the zone’s high unemployment. Germany, as it has throughout the crisis, led the way with a 0.7% quarterly growth, though Portugal and France were notable positive figures. Italy dragged down the results, falling -0.3% quarterly. Industrial activity as measured by the PMI surveys was in positive territory for August, cementing the sparks of hope that a turnaround is in play. Evidence of the market’s reaction was seen in sales of European junk bonds at a record $29 billion, up 70% year-to-date versus 2012 and spending on European industrial property returned to pre-crisis levels as €6 billion was spent by institutional investors during the first half of the year – up 60% year-on-year. However, consumers are still burdened with relatively high debt rations (e.g., Irish private sector debt is at 300% of their GDP and Spanish is north of 200%). European companies wrote off €350 billion in bad debts last year and banks need to cut €661 billion of assets and generate €47 billion in capital over the next five years to comply with the new EU regulations. Finally, the slowing auto purchases have hit the toll roads with traffic down 9% in Spain, over 6% in Portugal and 2.6% in Italy. Not good for government revenues…

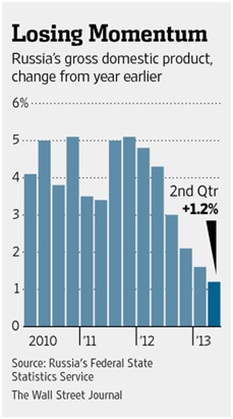

The UK turned in some positive sentiment in August with a narrowing trade deficit fueled by a resurgent auto export industry. British PMI and GDP numbers were better than the Eurozone’s and joblessness held at 7.8%. Despite this upswing, the new BoE  governor Mark Carney pledged low interest rates for the foreseeable future and is considering additional quantitative easing. While Germany put out a strong Q2 GDP number, industrial output collapsed in July, falling -1.7% (see left). Merkel is still on a solid track to be re-elected, not to worry. France also struggled since the GDP numbers were posted, with the latest being Holland’s plan to fill the growing unfunded pension gap by increasing worker and employer contributions (taxes) by 0.6% over the next three years. In addition, the contribution period would be also increased by one-and-a-half years to forty-three years spread out from 2020 until 2035, increasing revenues and also putting off disbursements. This second aspect sounds like something that we ought to do here in the US! Altogether, these changes may not look a lot but would be enough to raise billions of Euros per year and already the proposals have generated national protest, a sure sign of meaningful reform. Meanwhile Greece shifted back to a primary budget surplus… what is a “primary” budget surplus? It is the budget figure before interest expense… no small number in the case of Greece! Spending is down 20% and income is up 11% for the first seven months of 2013 but that still is a 7% deficit (€2 billion) so far. The country still needs roughly €10 billion additional to cover its ACTUAL deficits for the next two-three years. Russia may be vexing to Obama, but Putin is trying to distract his populace as the country’s growth rate slowed for the sixth consecutive quarter in Q2 (see right), and 2014’s forecast was lowered. Some weapons exports would nicely perk

governor Mark Carney pledged low interest rates for the foreseeable future and is considering additional quantitative easing. While Germany put out a strong Q2 GDP number, industrial output collapsed in July, falling -1.7% (see left). Merkel is still on a solid track to be re-elected, not to worry. France also struggled since the GDP numbers were posted, with the latest being Holland’s plan to fill the growing unfunded pension gap by increasing worker and employer contributions (taxes) by 0.6% over the next three years. In addition, the contribution period would be also increased by one-and-a-half years to forty-three years spread out from 2020 until 2035, increasing revenues and also putting off disbursements. This second aspect sounds like something that we ought to do here in the US! Altogether, these changes may not look a lot but would be enough to raise billions of Euros per year and already the proposals have generated national protest, a sure sign of meaningful reform. Meanwhile Greece shifted back to a primary budget surplus… what is a “primary” budget surplus? It is the budget figure before interest expense… no small number in the case of Greece! Spending is down 20% and income is up 11% for the first seven months of 2013 but that still is a 7% deficit (€2 billion) so far. The country still needs roughly €10 billion additional to cover its ACTUAL deficits for the next two-three years. Russia may be vexing to Obama, but Putin is trying to distract his populace as the country’s growth rate slowed for the sixth consecutive quarter in Q2 (see right), and 2014’s forecast was lowered. Some weapons exports would nicely perk up that industrial production! Finally in the banking sector, our old Franco-Belgium friend Dexia reported yet another loss of €905 million in the first half of 2013. France’s national auditor estimated that the French government alone has lost already €6.6 billion and faces further declines as assets were (conveniently) overvalued. Netherlands’ ING and ABN Amro, on the other hand, are at least stabilized if not recovering. ING confirmed that it is expecting to repay more of the €10 billion that it needed for its bailout (3/4ths have already been returned) and ABN Amro is considering to raise €15 billion via an IPO in 2014. Given that the bank received €30 billion from the Dutch government, there is still a considerable amount outstanding, especially if loss provisions continue to increase thanks to high consumer debt and the struggling Dutch economy. Welcome back from summer vacation!

up that industrial production! Finally in the banking sector, our old Franco-Belgium friend Dexia reported yet another loss of €905 million in the first half of 2013. France’s national auditor estimated that the French government alone has lost already €6.6 billion and faces further declines as assets were (conveniently) overvalued. Netherlands’ ING and ABN Amro, on the other hand, are at least stabilized if not recovering. ING confirmed that it is expecting to repay more of the €10 billion that it needed for its bailout (3/4ths have already been returned) and ABN Amro is considering to raise €15 billion via an IPO in 2014. Given that the bank received €30 billion from the Dutch government, there is still a considerable amount outstanding, especially if loss provisions continue to increase thanks to high consumer debt and the struggling Dutch economy. Welcome back from summer vacation!

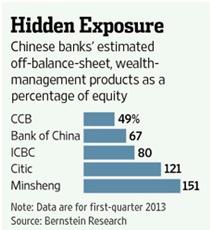

China Back in the House: China joined Europe in pushing out upgraded economic reports as total trade (both imports and exports) shifted positive year-on-year. Closely-watched exports beat expectations by growing +5.1% year-on-year in July versus +3.1% forecasted. July imports grew a more impressive +10.8% as commodities deliveries to the Middle Kingdom rebounded – such as iron ore at +27% and crude oil with +20% year-on-year. Industrial production ticked up to a +9.7% year-on-year pace from June’s +8.9% and retail sales held steady at +13.2%. Fixed-asset investment also re-accelerated to +20.1% for the first seven months of 2013. All told, 2013 GDP growth is expected to reach +7.5% – very good, but the slowest rate since 1990. All this success is coming with some concerns. Housing prices continue to move up, fanning the fires of inflation concerns and demonstrating the government’s inability to control the sector over the last year. The debt burden that we have talked much about finally received its due press by both the FT and WSJ with plenty of coverage on shadow banking – the borrowing of funds via off-balance-sheet private loans. As can be seen in the graphic to the right, off- balance sheet borrowing is an enormous percentage of bank capital. In addition, these banksare seeing a rapid increase in their non-performing loan book. CCB (China Construction Bank) announced that their overdue loans increased 21% during the first half of 2013 and Minsheng’s almost doubled during that same timeframe. While the non-performing loans are officially only 1-2% of total loans, one must suspect the numbers to be vastly understated or manipulated. Figures are elusive as to how much borrowing is done to simply keep current on the original loan, a compounding process that eventually bankrupts the borrower. As an example, Kunming Transport Investment, a government financing company for the local government of Kumning, has over $6 billion in debt, more than the city’s entire tax revenue, and the firm’s earnings are barely enough to cover the interest payments. Guiyang, one of China’s poorer cities, may officially have a debt ratio of 17% to municipal GDP, but once the government financing loans are added in, the ratio almost quadruples to 58%. Wei Yao, Societe General’s China Economist, estimates that debt servicing at the end of 2012 is equal to about 38% of GDP. While assets are nominally larger than liabilities, cashing out those assets, particularly in real estate (72% of non-performing assets) could cause a price collapse at best or are unsellable at worst. For example, Guiyang’s real estate holdings would take an estimated 28 years to sell off at official prices. The recent bloodbath in solar manufacturing also saddled banks with $2.3 billion in bad debt from one company alone, Wuxi Suntech Power. The situation is critical enough that S&P issued a formal warning on China in August after examining 151 of the country’s largest companies, with particular concern for those in the coal, metals, mining and transportation industries. Remember the old Warren Buffet adage, “Only when the tide goes out do you discover who’s been swimming naked.”

balance sheet borrowing is an enormous percentage of bank capital. In addition, these banksare seeing a rapid increase in their non-performing loan book. CCB (China Construction Bank) announced that their overdue loans increased 21% during the first half of 2013 and Minsheng’s almost doubled during that same timeframe. While the non-performing loans are officially only 1-2% of total loans, one must suspect the numbers to be vastly understated or manipulated. Figures are elusive as to how much borrowing is done to simply keep current on the original loan, a compounding process that eventually bankrupts the borrower. As an example, Kunming Transport Investment, a government financing company for the local government of Kumning, has over $6 billion in debt, more than the city’s entire tax revenue, and the firm’s earnings are barely enough to cover the interest payments. Guiyang, one of China’s poorer cities, may officially have a debt ratio of 17% to municipal GDP, but once the government financing loans are added in, the ratio almost quadruples to 58%. Wei Yao, Societe General’s China Economist, estimates that debt servicing at the end of 2012 is equal to about 38% of GDP. While assets are nominally larger than liabilities, cashing out those assets, particularly in real estate (72% of non-performing assets) could cause a price collapse at best or are unsellable at worst. For example, Guiyang’s real estate holdings would take an estimated 28 years to sell off at official prices. The recent bloodbath in solar manufacturing also saddled banks with $2.3 billion in bad debt from one company alone, Wuxi Suntech Power. The situation is critical enough that S&P issued a formal warning on China in August after examining 151 of the country’s largest companies, with particular concern for those in the coal, metals, mining and transportation industries. Remember the old Warren Buffet adage, “Only when the tide goes out do you discover who’s been swimming naked.”

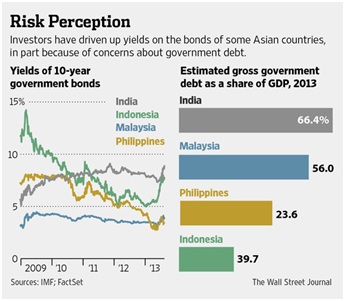

Japan put up a nice GDP number of +3.8% in Q2 on an annualized basis, surpassing the +2.6% preliminary number. However, the Abe government is looking to raise taxes beyond the planned increase in the consumption tax to try to rein in the exploding deficit so we shall see how long this lasts. Still wondering when they will restart their nuclear reactors instead of importing that expensive LNG. We warned of Indian debt  last month and August saw a plunge in the value of the rupee as its government stepped in with capital controls to try to slow a run on the currency. Under pressure from a faltering economy and sliding stock and bond market, India faces expensive energy imports (e.g., oil from Iran) that a collapsing currency will make more difficult to afford. Will the new celebrity central banker Raghuram Rajan save the day? Other Asian countries are more effectively fighting off malaise as Vietnam and South Korea have ramped up exports and government spending (Philippines too). Similar to Japan, South Korea has an issue with their nuclear reactors. However, this one is 100% the fault of humans as 23 reactors had forged safety certificates and three reactors are off-line. Will energy demands derail the recovery? Indonesia too is facing currency headwinds as its growth slowed in Q2. Some investors blame the increase in US bond rates due to Fed tapering concerns in the boosting of emerging market bond yields (examples seen in the graphic on the previous page) but the global economic slowdown too has posed challenges. Since May, central banks in the developing markets have lost $81 billion (2%) in reserves as currency outflows and interventions outpace trade inflows. Indonesia and Turkey each have spent 13% of their reserves and India 5.5%. It is not 1997 (yet) but a run here can be quite contagion-esq.

last month and August saw a plunge in the value of the rupee as its government stepped in with capital controls to try to slow a run on the currency. Under pressure from a faltering economy and sliding stock and bond market, India faces expensive energy imports (e.g., oil from Iran) that a collapsing currency will make more difficult to afford. Will the new celebrity central banker Raghuram Rajan save the day? Other Asian countries are more effectively fighting off malaise as Vietnam and South Korea have ramped up exports and government spending (Philippines too). Similar to Japan, South Korea has an issue with their nuclear reactors. However, this one is 100% the fault of humans as 23 reactors had forged safety certificates and three reactors are off-line. Will energy demands derail the recovery? Indonesia too is facing currency headwinds as its growth slowed in Q2. Some investors blame the increase in US bond rates due to Fed tapering concerns in the boosting of emerging market bond yields (examples seen in the graphic on the previous page) but the global economic slowdown too has posed challenges. Since May, central banks in the developing markets have lost $81 billion (2%) in reserves as currency outflows and interventions outpace trade inflows. Indonesia and Turkey each have spent 13% of their reserves and India 5.5%. It is not 1997 (yet) but a run here can be quite contagion-esq.

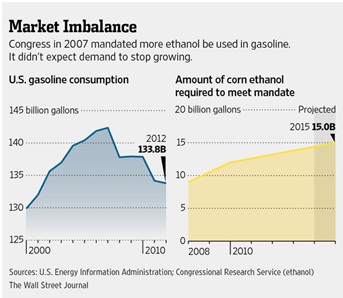

Mired in a Black Goo: Oil is back in the spotlight, thanks to the media hyping up a supposed link between Syria and Middle East oil. The real threat to oil production has already occurred: in Libya (a loss of 1.2 million barrels per day or 85% of production due to strikes and protests), Nigeria (300 thousand bpd or 15% of production from theft and civil strife), Angola and Iraq. Fortunately Saudi Arabia has stepped up with extra production but that lowers the excess capacity available in case of an emergency. Hence oil prices zoomed to $110 per barrel for West Texas Intermediate, the futures benchmark. More broadly in the US, we are rapidly reaching parity between crude oil imports and exports, as the Financial Times graph shows to the right. Demand is stronger this year, but it is the industrial products such as gasoil that are in demand, less so the more consumer-minded gasoline. Speaking of gasoline, the EPA finally recognized that the US government is demanding too much ethanol to be made and will propose lowering the

production but that lowers the excess capacity available in case of an emergency. Hence oil prices zoomed to $110 per barrel for West Texas Intermediate, the futures benchmark. More broadly in the US, we are rapidly reaching parity between crude oil imports and exports, as the Financial Times graph shows to the right. Demand is stronger this year, but it is the industrial products such as gasoil that are in demand, less so the more consumer-minded gasoline. Speaking of gasoline, the EPA finally recognized that the US government is demanding too much ethanol to be made and will propose lowering the  mandated consumption. As a quick reminder, Congress, as a sop to the politically important corn states, required a certain amount of ethanol to be made as a gasoline additive, regardless of the actual need. As the decline in gasoline demand over the last few years has correspondingly reduced the demand for ethanol, this policy became untenable. Success here in realigning dictated supply and demand depends on Congressional politics, not an optimistic situation. Sugar may be the ethanol fuel source of choice in Brazil but perhaps the US should consider it as sugar producers have defaulted on $35 million in federal loans due to global oversupply. With another $300 million in loans coming due in September, and US ethanol producers set up for corn not sugar, the federal government may be stuck with losses up to 75% as it tries to get rid of the sweet stuff. Finally in energy, Entergy announced its plans to close its Vermont Yankee nuclear power plant despite having another twenty years of life left as low natural gas prices from shale hurt the price of electricity. Enjoy a higher carbon footprint.

mandated consumption. As a quick reminder, Congress, as a sop to the politically important corn states, required a certain amount of ethanol to be made as a gasoline additive, regardless of the actual need. As the decline in gasoline demand over the last few years has correspondingly reduced the demand for ethanol, this policy became untenable. Success here in realigning dictated supply and demand depends on Congressional politics, not an optimistic situation. Sugar may be the ethanol fuel source of choice in Brazil but perhaps the US should consider it as sugar producers have defaulted on $35 million in federal loans due to global oversupply. With another $300 million in loans coming due in September, and US ethanol producers set up for corn not sugar, the federal government may be stuck with losses up to 75% as it tries to get rid of the sweet stuff. Finally in energy, Entergy announced its plans to close its Vermont Yankee nuclear power plant despite having another twenty years of life left as low natural gas prices from shale hurt the price of electricity. Enjoy a higher carbon footprint.

Livestock markets face a new challenge in meat production as Merek stopped sale of its growth supplement as evidence became unavoidable that Zilmax was associated with cattle being unable to walk and sitting in strange positions, like dogs (not sure what that would look like exactly but perhaps best not to know). It has been a tough few years for the business with feedlots closing from the costs of high corn (on average, US feedlots have lost money for a record 27 straight months) and general overexpansion before 2000. Now 20% fewer, US feedlots have higher costs if the lack of growth supplements requires more time on the lot before an animal reaches slaughter weight. A strong corn supply may be too little, too late. Despite the falling corn prices, US farmland prices kept on rising per the FT, moving up 9.4% in 2013 year-to-date. Institutional investors have been attracted to this asset as a way to put money to work in a low interest-rate environment. In the world of hogs, a key US committee gave its approval to the Shuanghui takeover of Smithfield Foods and the US Treasury is likely to give its blessing as well. Meanwhile Maine is struggling as a glut of lobster has cut prices in half since the heyday of almost ten years ago. Cattle for lobster? That could be an interesting trade!

In mining, Russia and Belarus are engaged in a potash war with Moscow threatening to cut oil exports to and dairy imports from the former Soviet Republic in retaliation for Belarus arresting the CEO of a Russian potash producer. Belarus last December withdrew from the eastern European potash cartel, deciding to chase higher volumes instead of maintaining artificially high prices, instigating this feud. I wonder if Putin finds Syrian politics a pleasure by comparison. Gold miners are facing the opposite issue with low gold prices and high production costs sending firms into a tailspin – three miners have been suspended from the Johannesburg Stock Exchange, 31 in Australia and 26 in Toronto’s junior exchange, unable to comply with even minimal listing requirements. About one-third of these firms are in or through bankruptcy or liquidation and the rest are teetering. Less supply in the future? Demand in China is still strong as demand hit 385.5 metric tons in Q2 2013, a record and double the demand in Q2 2012. They most certainly did buy on the dip! Famed investor and noted gold bull John Paulson shifted his gold exposure from an ETF to buying swaps as the cost of carry recently fell. Gold ETFs in total saw an outflow of 402 metric tons equivalent in Q2 – which was neatly offset by the Chinese buying.

Invest wisely!

David Burkart, CFA

Coloma Capital Futures®, LLC

Special contributor to aiSource

Additional information sources: Bloomberg, CFA Institute, Financial Times, R.J. O’Brien, New York Times, South Bay Research, United ICAP and Wall Street Journal.