July was a good month for risk, with the S&P 500, EAFE and the S&P GSCI all up around 5% for the month. Bonds at least treaded water, as US bonds as represented by the Barclays Aggregate squeezed out a 0.1% positive return and European sovereigns at +0.8%. The animal spirits side of the house cheered the Federal Reserve’s dovish talk as Bernanke threw credibility to the wind to placate his financial and political masters. Draghi also jumped in with his me-too cheerleading, claiming at the end of the month that “the Euro region is past the worst of its longest-ever recession.” China this month also began to back off from its tough rhetoric as it considered new stimulus. The IMF may have cut its 2013 and 2014 global growth forecasts by 0.2% for each year, but not to worry – that just means more monetary stimulus! Hopefully the US budget negotiations will not spoil the party. Perhaps the most interesting commodities-related note was the announcement that US domestic oil output is expected to exceed US oil imports in October this year. George Mitchell, the “Father of Fracking” who died this month, should be credited for this turnaround in energy access. Although the Barnett Shale was well known for its potential since the 1940s, it took seventeen years of Mitchell’s direction (and expense) to crack the code and release the trapped gas. Regardless of your view on fracking, he profoundly changed energy production and security issues for the next number of decades.

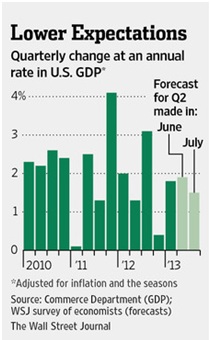

Taperworm: Again the US economy displayed its wishy-washy nature with selected pick-ups in some measures and underwhelming results in others. This back and forth will keep the market attuned for more QE / deferred tapering. On the negative side, rolling four-quarter economic growth stayed below 2% as Q2 GDP came in at +1.7% after a revised +1.1% in Q1. Retail sales came in +0.4% in June and if you exclude autos and gasoline, then spending actually dropped -0.1%. May’s figure was also revised down from +0.6% to +0.5%.

The unemployment rate fell to 7.4%, inching to that “taper-ready” zone but the non-farm payrolls at +162,000 jobs in July does not indicate strong growth, especially considering that almost 20% of the seasonally-adjusted jobs were part-time (on par with the other months’ part-time percentage since the 2009 recession). Mostly in the restaurant business, these jobs are double-edged – they show the willingness of Americans to spend discretionary income on eating out but average weekly earnings in that sector are about half the figure of all private industries, limiting its positive impact on the economy. Some point to the part-time hiring as pushing down hours to avoid Obamacare mandates (i.e., more than 30 hours per week is considered full-time), however, leisure and hospitality sector workweeks have long had part-time workers that have been subject to such practices.

Finally, another data point on economic stress is that the percentage of college students living at home from families with incomes over $100,000 has doubled to 48%, according to Sallie Mae research. On the plus side, US factories posted their best month in two years with an ISM reading of 55.4, up significantly from 50.9 in June. Although volatile (see left) and relatively modest as part of the US economy, that sector played its part. Automobile demand stayed strong as overall vehicle sales are up 8% so far this year versus last year. Finally, that old favorite, new home sales surged by 8.3% in June month-on-month (+38% year-on-year), with a 7.4% higher median home price paid year-on-year. With mortgage rates trending higher, there was likely a rush to purchase. All-in-all, it is a mixed bag – a fragile recovery if I ever saw one.

The Fed news was mostly around Ben Bernanke scurrying for cover, rescinding the tapering noises he had made last month. Vowing no retreat from his easy money policy, he verbally jumped through hoops to say that he would not cut QE and even if he did, it would not mean that he or his successor would raise rates. Given that his successors are most likely Yellen, committed to free money as the panacea for all ills, or Summers, a rank opportunist who will say and do anything to feed his ambition, it seems to me that the odds are low that tapering QE will happen in 2014 or anytime in the next five years (the term of the Fed Chair). Perhaps Bernanke is happy to get out while the banks are just starting up the asset-backed security markets. Blackstone and Deutsche Bank are looking to bundle 1500-1700 monthly rental payments and sell the tranches to investors seeking yield. Yes, the exit of the private equity buyout of the family home is being sold off to greater fools, just like the mortgage securities that blew up in 2008-2009. If this securitization comes through, it will complete the current trend in collateralized loan obligations (bonds made up of bank loans) which are adding more and more leverage to their asset-backed bonds – typically via a new tranche of junk-rated debt to satisfy yield-starved investors. With $42 billion in CLO issuance this year so far versus $53 billion in all of last year, it seems that financial companies are trying to get out while the getting is good.

Summer Doldrums: Draghi’s exhortations aside, there are few glimmers present in Europe. The IMF 2013 forecast update cited earlier knocked the EU GDP growth down to -0.6% for the year, with the largest negative adjustments in Italy (-0.3% adjustment to -1.8% for 2013) and Spain (-0.7% adjustment to 0.0% for 2013). Eurozone property prices hit a 7-year low with Germany and Austria still surging but being offset by the Netherlands, Spain, Ireland and others. May exports fell -2.3% as China cut its imports, hurting Germany, though Portugal, Italy, Greece and Spain (AKA PIGS) showed improvements. EU new car sales fell -5.6% to the lowest level since 1996 as only the UK showed a rise in registrations. On the plus side, EU unemployment improved for the first time in almost 2½ years by +0.1%, from 11.0% to 10.9% AKA statistically insignificant. That news was offset by the announcement that the French military are looking to cut an additional 34,000 positions (-12%) on top of the 50,000 reductions already made as well as halving the number of fighter jets it plans on purchasing. Europe’s manufacturing also peaked above 50 to 50.3 in July, showing a small expansion. Looking ahead, German elections will be held on the 22nd of September – Merkel is still favored but one wonders if will there be a change in policy as she has stated that this would be her last term as Chancellor. As a “lame duck,” she may more aggressively craft her legacy, which may not be so supportive of her Club Med and French colleagues. For example, the end of the Greek, Portuguese and Cypriot bailouts is set for early and mid-2014 and early 2015, respectfully and when they cry for more money, the Germans may not be so generous.

And the Greeks sure do need more money! As expected from last month’s commentary, they were cleared to receive €6.6 billion in July in exchange for further planned reductions in the civil service payroll (25,000 persons will have eight months to look for another job while at lower pay or face the door). By the end of the month, privatization of the Greek lottery system was okayed for sale, which would allow the country to hit its 2013 goal of €1.6 billion (knocked down from €2.6 billion due to the failed deal to sell the national gas company to Gazprom mentioned last month).

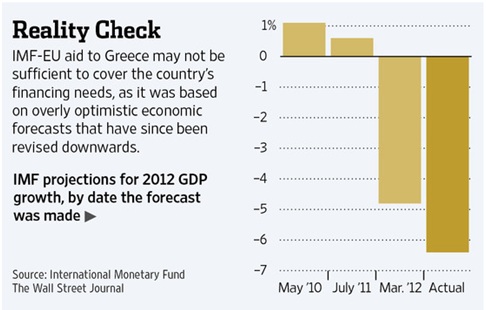

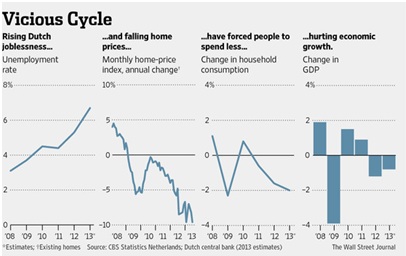

Unfortunately, the IMF announced at the end of July that Greek bailout package will fall €11 billion short based on their revised estimates that incorporate current data. Even worse is Greece’s need to fill about half that gap by the end of this year (post-Merkel election?) as well as to meet its debt-to-GDP goal of 176%, €7.4 billion needs to be forgiven by the other European governments. So the troika is throwing good money after bad as well as a direct loss that German politicians have promised to their taxpayers as something that would never happen. Double delusional! At least Spain managed to have a decline in their unemployment rate – from 27.2% to 26.3%. That killjoy IMF though projects that the rate will stay above 25% for the next five years, however. Spanish GDP fell by the lowest amount in nearly two years in Q2 (-0.1%) and many banks showed small profits. As always, sustainability is the question. The Dutch have moved to the forefront of concerns as their economic metrics have worsened across the board.

As a “core” European country, weakness here can rebound onto the ECB credit rating and other pan-Europe financing. Again, this should not be a surprise to readers of this missive. On that note, Fitch (who? Yes, Fitch) cut France’s AAA credit rating, which in turn hit the EFSF’s credit rating, knocking the bailout fund down one peg to AA+. France received permission at the end of the month to guarantee Peugeot’s financing unit to the tune of €7 billion, underscoring that auto company’s ailing financial situation as well as the French government’s willingness to bail out its firms. Will they have (more) money for other countries/banks in trouble? Ireland’s government on the other hand is taking austerity so seriously that it is planning to close its upper house of Parliament, looking to save €20 million per year by cutting 60 elected officials. Can you imagine a similar event happening in the US or your own country? Finally, Cypriot officials are looking to hit excess deposits at Bank of Cyprus for a 47% haircut with an additional 10% holdback in an escrow account to cover excess losses. It will be years before those depositors see their money.

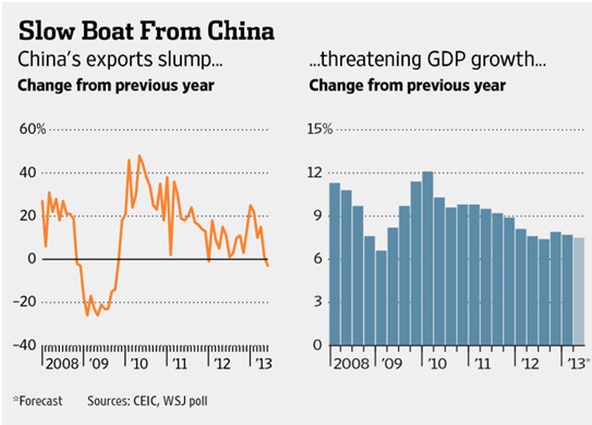

China Re-Rising? The beginning of the month continued the negative stories on the Chinese economy as the big industry slowdown raises the tough questions for the country’s leadership. After a slow start to the month, the government hinted at accepting a lower economic growth rate, implying that 6.5% or 7% may be acceptable.

The IMF’s updated 2013 forecast also lowered Chinese GDP growth, by -0.6% to 7.7%. Some of the details are seen in the export-oriented firms. For example, Shipbuilder China Rongsheng Heavy Industries announced that it was struggling to pay employees, even after 8,000 layoffs from its 20,000 member workforce. Non-pay for April and May was causing unrest and strikes, but with debt ballooning from $600 million to $4.0 billion in two years and negative operating cash for four years means big trouble. Why the collapse? Shipbuilding overcapacity and slowing export market. Auto exports too have struggled – primarily to Iraq, Iran, Venezuela and Vietnam. The first six months of 2013 are flat versus 2012 but the Chinese auto makers are geared for high growth as 2012 was 30% larger than 2011. Strong currency, wage appreciation and sluggish foreign demand all are weighing on the export economy. On the other hand, domestic demand has held up and Chinese tourists have doubled over the last five years, with arrivals to Australia up by 19% this year over last so far. By the end of the month, the government struck back. On the financial market side, Beijing further liberalized consumer interest rates as well as re-launched state bond futures trading. In addition, the central government launched an audit of government debt from municipal level up to national level to see who owes whom. The findings will be fascinating, if they are shared. Finally, on the fiscal side, the State Council (the national cabinet) announced a “mini-stimulus” focused on small business taxes, administration and financing.

Japan’s Abenomics is still on trial – unemployment fell to 3.9% in June, the lowest since fall 2008, but industrial production also declined by 3.3%. The massive government deficit stills needs to be filled and the expected tool is the ever-popular consumption tax. The proposal is to increase it from 5% to 8% in April 2014 and again to 10% in October 2015, which is expected to have a 1.5% hit to annual GDP – to an economy that is barely growing.

Further increases are expected after 2015. Although the political verbiage says that it is planned for when the economy “is on a solid recovery track,” that day may not arrive in time to fill that massive hole seen to the left. Turning briefly to India, that country’s bad loan situation is also increasing, with Fitch (yet again) estimating that bad and restructured debt will be 12% of the total (Rs 3.5 trillion or $60 billion) or double the level of two years ago. As usual, these “restructured” debts are often in a holding pattern before being recognized as actually unpayable. Watch for more on this story in the months to come.

You Are What You Eat: All indications are there for a bumper US crop in corn and a very healthy-sized one in soy thanks to mild weather this year. Crop conditions are maintaining a higher-than-historical level and yields could approach 160 bushels per acre. Southern fields are almost ripe for harvest, in plenty of time for September contract delivery. The late start by the prime corn states though has the market more focused on the December futures contract. 2014 Brazilian indications by JP Morgan look to another strong soy planting with a small decline in corn area to make room for slightly more soy. Normal Brazilian weather conditions are expected for the December 2013 to February 2014, but variations could materially move (+/- 5%) the global ending stocks-to-use projection (again JPM) of 23%. One of the larger agricultural news items is the collapse of the potash cartel due to the pullout of Uralkali, the largest producer by capacity in Russia and the world. While the fertilizer was already half of its 2009 high price, the market fell to new pressure. This could spur more planting next year thanks to lower input costs. Arabica coffee prices have fallen down to 2009 levels, less than half the peak of the 2011 highs – increasing its use in blends with cheaper, lower quality Robusta beans. No expectations to see cheaper Starbucks prices, particularly as the best beans from Central America have been devastated by fungus – the infamous leaf rust la roya. Cocoa futures at least are perking up due to increased chocolate demand – I guess these tough economic conditions are increasing the demand for endorphins…

Oil markets were upended as US WTI prices moved above Brent for the first time in almost three years as inventories at the primary delivery point declined. So what about this shale boom that we have all been hearing about? Well, that supply has been going directly to the refineries at the Gulf of Mexico or the Atlantic states, often bypassing the traditional hub of Cushing, Oklahoma. Funny enough, the Wall Street Journal ran a story stating that “big oil” (e.g., Royal Dutch Shell, Exxon Mobil, Chevron) is not profiting from many of these shale opportunities, with write-downs from overpriced properties and exposure not to oil but to low-priced natural gas hurting profits. In an update to the 25-year contract between Russia and China, Rosneft inked a deal to ship $270 billion of oil over the life of the agreement. In addition, state-owned China National Petroleum Corporation contributed $4 billion for 20% of LNG project in exchange for three million tonnes of LNG per year which will increase Russian LNG exports to China by 20%. Saudi Arabia and the UAE pledged $8 billion in aid to Egypt in addition to the natural gas shipments gifted by Qatar mentioned last commentary. With a mix of loans, oil products and cash gifts, the Gulf States have drawn their line in the sand against the Muslim Brotherhood.

Invest wisely!

David Burkart, CFA

Coloma Capital Futures®, LLC

Special contributor to aiSource

Additional information sources: Bloomberg, CFA Institute, Financial Times, New York Times, R.J. O’Brien, South Bay Research, United ICAP and Wall Street Journal.