Going off one of our past newsletters in explaining the differences between Discretionary and Systematic managers, this newsletter will encompass the unique qualities and major differences between Fundamental and Technical CTA’s. Whether you are a new investor or an experienced investor of managed futures, it is crucial to understand the differences between fundamental and technical managers. As we dig deeper and understand each separately, it is important to recognize that each approach brings added value to one’s overall portfolio, and investing in both simultaneously can many times be a logical decision.

In their simplest form, fundamental and technical analysis refer to the methodologies used for researching and forecasting future trends in market price, whether it be long term or short term. Like other investment strategies, both have their pluses and minuses. But how is one to determine which is better for their investing needs? Let’s move on and analyze each separately.

Fundamental analysis is a method of evaluating a specific market, which involves measuring the intrinsic value by examining related economic, financial and other qualitative and quantitative factors. Fundamental managers use the concepts of macroeconomics and other factors that affect the overall economy to help assess the underlying price of any given market. Concepts such as monetary policy, production, domestic/foreign supply and demand, and weather greatly affect price. The eventual goal is to produce a value of the underlying current market price in helping determine whether the current price is over/under priced allowing the manager to take a position in the market.

In contrast, technical analysis is a technique of evaluating markets by analyzing statistics such as price, volume, and open interest. Technical analysts/managers do not attempt to measure intrinsic value, but rather use charts, moving averages and other statistical tools to identify price patterns to help predict future price. Most technical analysts believe that historical performance is a good indication on future performance (disclaimer: past performance is not indicative of future results). There are hundreds of different technical indicators that analysts may use but a few of the more popular one’s include, bollinger bands, stochastics, moving averages, and MACD.

The question in everyone’s mind right now is probably: “Which type of CTA is ‘better?’”

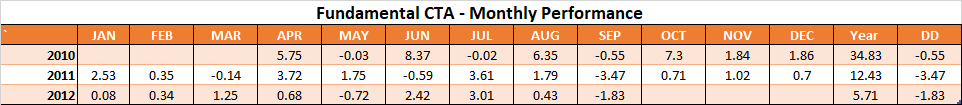

The appropriate answer to that question is that they are both good in a their own way. A well diversified managed futures portfolio should contain a healthy mixture of both types of CTAs (along with other types of CTAs). For example, let’s take a look at a CTA that’s a strict technical trader and compare that to a CTA that is a strict fundamental trader. After looking at them individually, we will then combine the two, and see if the performance of the two combined is any better than them individually. Without naming names but using actual returns, here is the performance for the fundamental CTA, which will be called “Fundamental CTA:”

In order for us to compare the Fundamental CTA to the Technical CTA, we did our best to find real CTAs, whose inceptions were in April 2010, for the sake of having a comparable performance table. Here is the “Technical CTA” performance:

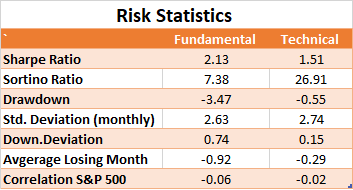

Comparing the two CTAs’ performance [only], it seems that investing with either CTA wouldn’t seem to be such a bad choice. The next logical step would be to look at some common risk statistics for each CTA:

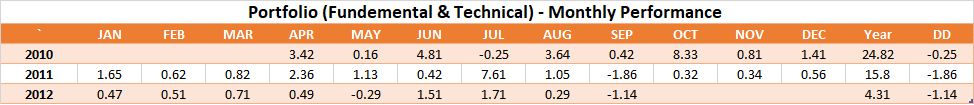

As you can see in the above table, some risk statistics favor the Fundamental CTA, while others favor the Technical CTA. Because both of the CTAs that we are comparing are inherently different from one another in terms of their trading strategy, style, and markets traded, it is completely within reason to be invested in both CTAs. Assuming a vacuum (meaning you are not invested with any other CTA besides the two above), what would the performance look like of someone having an equal investment in each of the above CTAs? See below:

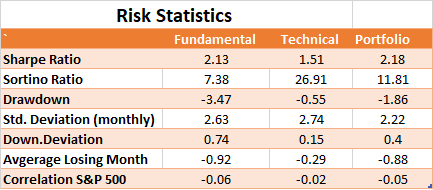

Most of you are now probably scrolling up to compare the portfolio performance to the individual performance of each CTA – the logical question in your head being “Am I better off investing in both or investing in only one or the other?” While the returns of the portfolio on an average annual basis are lower in the portfolio versus the fundamental trader, so are the drawdowns. Further, the returns of the portfolio are higher than the technical, but so are the drawdowns. Besides offering diversification, the portfolio of the two CTAs combined has shown better performance on a risk-adjusted basis, than either CTA has shown on an individual basis. Essentially, the portfolio finds a “middle-ground” between the two CTAs, and brings a better balance to the returns and drawdowns. While this may not be so evident when looking at the performance table, it becomes more evident when comparing the risk statistics of the portfolio versus the CTAs separately:

In conclusion, it’s safe to say that investing in both the CTAs simultaneously not only gives you better diversification, because of the inherent differences between the two, but it has also historically shown to produce a more balanced return to drawdown stream. What happens in the future could be totally different, and hence why you see the popular disclaimer about how “past performance is not indicative of future results.” Investing in managed futures – or any investment – is an on-going process, and that is why we are here to help produce and provide results for analyses similar to the one done above.

-Rishab Sharma

Disclaimer: Please use the above material strictly for educational purposes. Past performance is not indicative of future results. Futures trading involves substantial risk of loss. By no means is this newsletter offering any investment advice or suggesting to make any trade recommendations. Please consult an aiSource advisor prior to opening any managed futures accounts.