How does investing in Managed Futures work?

Managed futures may seem somewhat confusing to new investors. To better understand what managed futures programs are, it is helpful to consider what they are not: managed futures investments are not the equivalent of stocks of commodity-driven companies, nor are they trend-driven mutual funds or exchange-traded funds (ETF).

Instead, managed futures offer investors the opportunity to invest in the global futures markets through a CTA, a professional who manages client assets based on agreed-upon investment strategies and conducts trading on their behalf. CTAs develop unique investment approaches that take a variety of forms, ranging from trend-following strategies that aim to profit from market changes to market-neutral approaches that rely on more conservative methods, as well as a diverse set of combination methods.

Funding Requirements

Managed futures funding requirements are as diverse as CTA strategies and the global futures markets on which they trade. Most CTAs require a minimum investment level, which typically falls between $25,000 and $5,000,000. Some CTAs further require a minimum net worth or income level. These amounts are based on a CTA’s level of experience, target investment audience, trading strategy and past performance.

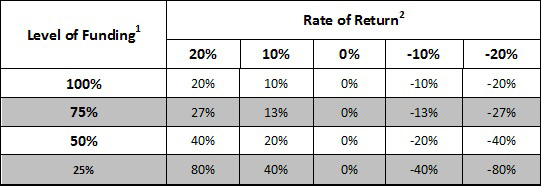

Many CTAs offer clients the option of notional funding, which allows investors to leverage their managed futures accounts. Because the notionally funded amount is not borrowed or deposited, but instead acts as a good faith deposit for the full value of the account, this leverage does not incur additional cost. While notional funding is attractive to many investors, others are cautious of its increased volatility; with notational funding, all gains and losses are multiplied proportional to the level of funding provided.

A $100,000 account that is notionally funded at 50 percent, for example, requires an investment of $50,000. The account would be traded as if it were fully funded at the $100,000 level. If the account sees a 10 percent return, the investor thus receives a $10,000 profit, equal to 20 percent of the actual funding provided. If, however, the account experiences a loss of 10 percent, the account is debited $10,000, amounting to a 20 percent loss of funds.

Understanding the Fee Structure

There are two major fees associated with managed futures investments. The first fee, the management fee, provides compensation for a CTA’s investment management services. This annual fee is generally deducted from investor accounts on a prorated, monthly basis. The amount of the fee typically ranges from 0 to 2 percent and is based on the specific investment program and the CTA’s experience level.

Some CTAs waive the management fee in favor of the second major fee associated with managed futures accounts: the performance, or incentive, fee. While certain CTAs do not charge a management fee, all accounts are subject to an incentive fee. This fee usually falls between 20 and 30 percent of investment profits. The incentive fee provides the CTA with the motivation—or incentive—to maximize performance; as the investor profits, so does the CTA. The incentive fee acts as a CTA’s main source of income.

Many CTAs apply a high watermark to investor accounts. With the condition of a high watermark, a manager receives an incentive fee only on the amount of money that exceeds the account’s prior highest value. Should the investment drop in value, the CTA does not receive an incentive fee until the account is restored to a level above that watermark. Under this fee structure, CTAs receive incentive fees only on net new profits.

Disclosure Documents and Background Research

A CTA’s disclosure document fully explains the process of investing in a managed futures account. The disclosure document, or D-Doc, as it is commonly called, outlines important information about managed futures investments in general and with respect to the CTA’s specific program. The D-Doc describes all potential risk factors and required fees associated with investment. The document also provides information about the CTA, including background information, trading methodologies and performance history. Performance metrics included in disclosure documents are standardized, allowing investors to accurately compare CTAs.

Careful study of a CTA’s disclosure document is a critical part of the investment decision-making process. Potential investors should request a CTA’s D-Doc before making any investment decisions and should fully understand the document before signing the included agreement that authorizes the CTA to direct trading in their accounts. CTAs must update disclosure documents at least every nine months, but investors can request more recent performance information if necessary. The CFTC and the NFA (including its Background Affiliation Status Information Center—or BASIC—database) provide investors with further information about individual CTAs.